Table of Contents

Journey insurance coverage is extra ubiquitous than ever due to COVID-19’s cruel assault on the journey trade. It’s pushed by journey brokers and planners, and prominently positioned on the checkout web page of resort and airline web sites.

However is journey insurance coverage price it? And what does journey insurance coverage cowl? The reply to each these questions completely depends upon your journey. Personally, I’ve at all times opted in opposition to it, however that doesn’t imply I’m taking a monetary threat ought to bother come up. Actually, I’ve obtained 1000’s of {dollars} in compensation for issues which have gone mistaken.

I’ll present you the way I do it — and whether or not you need to take into account shopping for journey insurance coverage.

What’s Forward:

What does journey insurance coverage cowl?

There are numerous kinds of journey insurance coverage to cowl a wide range of journey purchases. Listed below are essentially the most outstanding coverages:

- Baggage delay insurance coverage. Reimburses you within the occasion that your checked baggage is delayed. You’ll get cash for issues like toiletries and garments for those who want them.

- Journey cancellation insurance coverage. Reimburses you for pay as you go nonrefundable journey in case one thing goes mistaken earlier than your journey begins.

- Journey interruption insurance coverage. Covers pay as you go bills that you simply didn’t get to make use of if one thing goes mistaken whilst you’re in your journey.

- Emergency medical transportation. Pays so that you can be taken to a particular facility due to harm or sickness throughout your journey.

- Journey delay insurance coverage. Reimburses you in case your journey is delayed for a selected period of time (for instance, your flight is cancelled and you will need to keep in a single day). You’ll be lined for issues like lodging, toiletries, meals, and so forth.

- Main rental automobile insurance coverage. Covers you as much as the money worth of most automobiles for theft or injury. It gained’t cowl the automobile you slam into, or any accidents to folks contained in the automobile.

You may as well buy Cancel For Any Purpose (CFAR) insurance coverage, which lets you obtain a big portion of your airfare as a refund (generally as much as 90%) for a small cost. Because the title suggests, you possibly can cancel your journey merely since you modified your thoughts.

Do I really want journey insurance coverage?

You don’t want journey insurance coverage.

The actual fact is that even with the journey trade in a little bit of turmoil due to the residuals of coronavirus restrictions, you in all probability gained’t use it. Nevertheless, if misfortune shoehorns its manner into your trip, you might need to pony up 1000’s of {dollars} that might in any other case have been lined by paying a nominal price upfront. The peace of thoughts that comes with journey insurance coverage could itself be definitely worth the cash.

Good instance — throughout a visit to Eire, insurance coverage saved me twice:

- My checked bag by no means confirmed up in Dublin. As a result of I had baggage delay insurance coverage, I obtained $500 to purchase new garments.

- I scraped my rental automobile in a parking storage. The rental company charged $2,400 to get it fastened. However as a result of I had major rental automobile insurance coverage, I didn’t should pay a shiny dime.

That kind of stuff doesn’t normally occur. However there are a number of key insurances that I at all times be certain that I’ve, simply in case.

Wait. Didn’t I say earlier that I by no means purchase journey insurance coverage?

Effectively, I get my insurance coverage without spending a dime by reserving my flights and rental automobiles with my Chase Sapphire Most popular® Card. However for those who don’t have a bank card that features insurance coverage, you can even purchase a coverage that features these items for about $100 or extra — together with different useful coverages you gained’t discover on a card, equivalent to COVID-19 cancellation.

Once more, cancel for Any Purpose (CFAR) insurance coverage is particularly helpful these days within the wake of all of the latest mayhem inflicted on the journey trade.

The place to get journey insurance coverage

In the event you’re seeking to purchase insurance coverage, there are a number of respected suppliers. Websites like Seven Corners, John Hancock, and Tin Leg supply a great deal of choices, so it’s simple to customise your insurance coverage for precisely what you want.

Listed below are some value factors:

In the event you’re touring abroad and are scared about coronavirus sticking its finger in your plans, you possibly can tailor a coverage from Seven Corners for $65 that comes with advantages like:

- Journey cancellation and interruption protection

- Medical protection for COVID-19

- Protection for medical quarantine

- No medical deductible

In the event you’re touring to Miami throughout hurricane season and plan to lease a automobile, you possibly can cobble collectively a plan from John Hancock for $106 that covers:

- Journey cancellation and interruption

- Hurricane and climate insurance coverage protecting flight delays as much as 48 hours, and reimbursing you for those who should depart your lodging on account of climate

- CFAR insurance coverage, supplying you with the choice to easily change your thoughts for those who don’t wish to cope with the unknowns, and obtain 75% of your a reimbursement

- Rental automobile insurance coverage protecting as much as $50,000 in case inclement climate equivalent to floods injury the automobile

In the event you’re taking a cruise, a $38 Tin Leg insurance coverage coverage can get you all of the advised coverages for that exercise, equivalent to:

- Hurricane and climate insurance coverage

- Medical protection for COVID-19

- Medical evacuation and repatriation as much as $250,000

- Journey delay (kicks in after six hours)

- Baggage and private gadgets lack of as much as $500

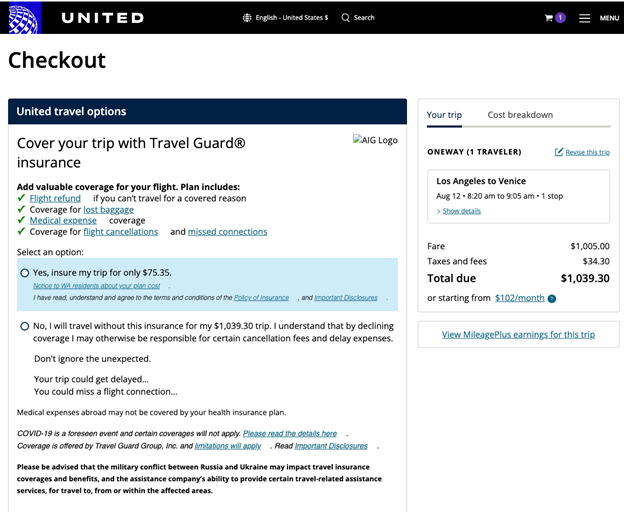

However the most typical time you’ll in all probability be tempted to purchase insurance coverage is on the checkout web page of an airline web site. Right here, you’ll discover insurance coverage that gives issues like journey cancellation insurance coverage, misplaced baggage insurance coverage, and medical insurance coverage. You’ll additionally get a wholesome dose of alarmism and fearmongering.

Under is a dummy reserving with United Airways simply to verify costs. For a $1,039 flight to Venice, you’ll be pitched an insurance coverage coverage for $75.35.

Supply: United.com, screenshot by Sarah Hostetler

You would get a really comparable coverage by means of Tin Leg for $52. Nevertheless, it’s possible you’ll discover the comfort of merely clicking a verify field price the additional $23.

It’s additionally extraordinarily vital to do not forget that, as I discussed earlier, sure journey rewards bank cards include built-in journey insurance coverage. So long as you pay in your journey with certainly one of these playing cards, you’ll obtain automated protection.

Which is strictly what I do.