Table of Contents

The co-founder and CEO of a so-called “tech-enabled residential mortgage servicer” named Valon (previously Peach Road) has warned we could possibly be getting ready to one other foreclosures disaster.

Whereas actual property is flying excessive in the intervening time, it’s seems that two very totally different tales are unfolding on the identical actual time.

On the one hand, the housing market has by no means been hotter, with provide at document lows and dwindling, whereas demand from potential consumers skyrockets.

In the meantime, dwelling builders are taking part in catch-up, which has pushed property values to all-time highs, with an extra 10% enhance anticipated in 2021.

Then there’s the opposite story, which acquired some press early final spring when the pandemic took maintain, however has since been considerably ignored.

Practically 3 Million Householders Have Their Mortgage Funds on Maintain

- At present 2.7 million debtors are collaborating in COVID-19 mortgage forbearance

- These packages primarily put funds on maintain for as much as 360 days

- However as soon as the forbearance ends the borrower should at the very least resume common funds

- This might result in one other wave of brief gross sales and foreclosures if the financial system doesn’t get again on observe

There are 2.7 million U.S. owners in mortgage forbearance plans in the intervening time, which represents 5.38% of mortgage servicers’ portfolio quantity, per the most recent weekly report from the MBA.

These debtors primarily have their funds on maintain for as much as 360 days as a result of a COVID-19-related situation, equivalent to unemployment or diminished earnings.

It’s even worse for government-backed loans like FHA loans and VA loans, with the Ginnie Mae forbearance fee at 7.61%.

Merely put, there are tens of millions of current owners unable to make funds, and scores of potential consumers unable to land a property as a result of provide constraints.

Sooner or later, these two tales will merge, and it might land us proper again in one other foreclosures disaster, just like what was seen again in 2008.

What Occurs When the Mortgage Forbearance Runs Out?

- Utilizing a conservative estimate of 20% of debtors in forbearance falling into foreclosures

- We might be again at 2008 ranges with a 1.8% foreclosures fee throughout all housing

- This might result in one other downturn just like what was skilled a decade in the past

- However higher mortgage servicing and extra environment friendly loss mitigation has the potential to curtail a few of this adverse exercise

One factor that ought to concern any home-owner, potential dwelling purchaser, and mortgage servicer (the entity that collects month-to-month funds) is what occurs post-forbearance.

Whereas there are a selection of options to pay again the forbearance, equivalent to a partial declare or cost deferral, most count on the home-owner to renew common funds.

Meaning they received’t essentially should pay again the missed funds instantly (no lump sum essential), however they’ll at the very least should get again to creating common month-to-month funds.

In the event that they’re unable to do this, probably as a result of a shuttered small enterprise or long-term unemployment (or COVID-19 sickness), they could be supplied a mortgage modification plan.

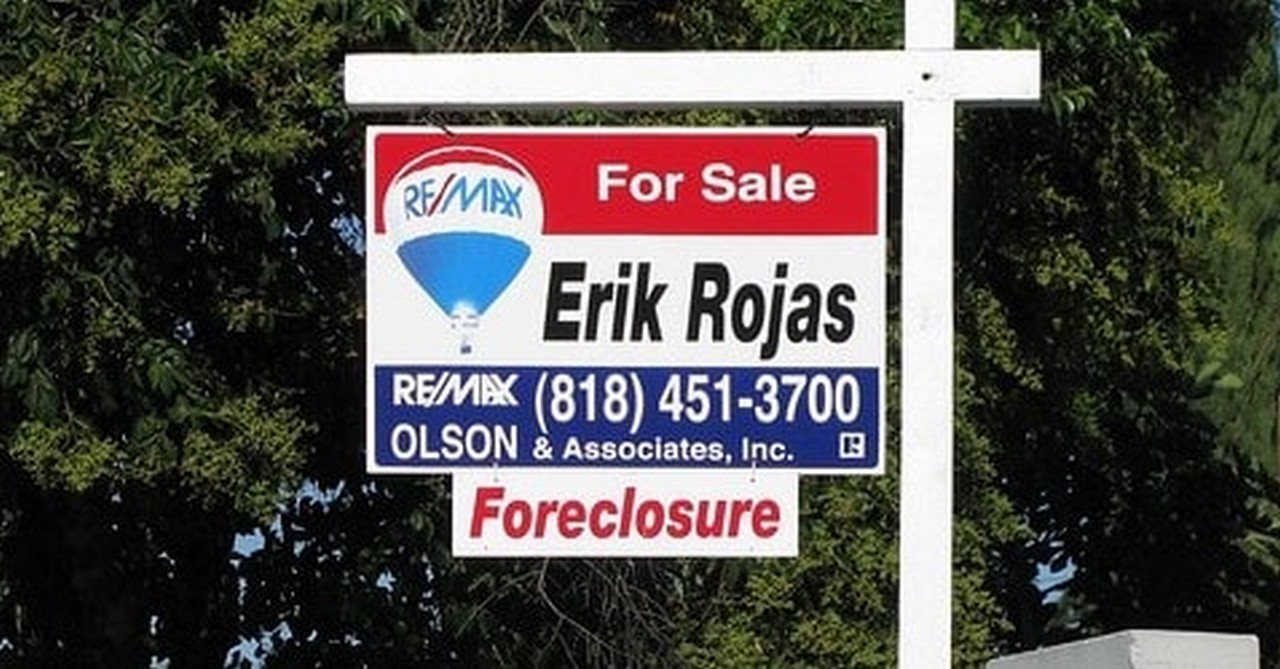

However for some, the truth goes to be the lack of the property, both through a brief sale, deed-in-lieu of foreclosures, or straight up foreclosures.

Valon co-founder and CEO Andrew Wang advised me that the “forbearance and foreclosures moratoriums had been a short lived repair,” and that the “stockpiling of forbearance and foreclosures will come to a head when these leniencies are lifted.”

Whereas he does consider authorities efforts might help us keep away from a full-scale industry-wide disaster, there’s nonetheless a very good probability many Individuals will lose their houses.

He expects “some within the forbearance pool might be OK,” however others might want to “transfer to liquidation situations – practically all of which requires a homebuyer to depart their dwelling.”

Meaning one other wave of brief gross sales and foreclosures, just like what was seen a few decade in the past when dwelling costs plummeted in the course of the Nice Recession.

“Even when a conservative 20% of the present loans in forbearance transfer ahead as foreclosures, we’ll be again at that stage,” he added, noting the comparability to the 1.8% foreclosures fee for all housing in 2008.

Disrupting the Stale Mortgage Servicer Mannequin

- Valon says the biggest mortgage servicing software program controls greater than half of all U.S. residential loans

- This efficient monopoly has apparently pushed servicing prices up practically 250% previously decade

- Their mobile-first cloud pushed platform can cut back prices and enhance borrower’s entry to mortgage info

- A extra empowered borrower working with a extra environment friendly servicer might cut back foreclosures and assist us keep away from one other disaster

So that you is likely to be questioning how Valon might help us keep away from one other foreclosures disaster?

Properly, their mission is basically to disrupt the stale mortgage servicing {industry}, which like all components of the house mortgage course of, was in dire want of a refresh.

Their mobile-first mortgage servicing software program that’s constructed within the cloud (Google Cloud particularly) can cut back servicing prices by 50% and enhance borrower self-service capabilities.

These options embrace improved entry to their dwelling mortgage info and the power to make funds from wherever they’re utilizing a easy interface.

In addition they consider their tech can get rid of prolonged paper-intensive processes related to loss mitigation and doubtlessly preserve extra Individuals of their houses.

In spite of everything, there are many debtors who by no means even know they’ve choices to keep away from foreclosures merely due to poor (or no) communication from their mortgage servicer.

And when you concentrate on how a lot time a house owner spends with their mortgage servicer (doubtlessly all the mortgage time period) vs. their lender (a month or so), you notice the significance of getting it proper.

Valon simply raised $50 million in Sequence A Funding, led by Andreessen Horowitz, and gained Fannie Mae approval to service agency-backed residential mortgages.

They are going to use the proceeds to amass extra mortgage servicing rights (MSR), with commitments already in place to develop to roughly $10 billion in servicing quantity this 12 months.

Valon operates in 49 states, and expects so as to add New York to the fold later this 12 months.

Not solely do they suppose they’ll cut back servicing prices, which might in flip move financial savings onto shoppers, they consider a technology-enabled various can preserve debtors higher knowledgeable.

And a better-informed borrower might know simply that little bit extra to truly preserve their dwelling, thereby serving to us all keep away from one other full-scale disaster.