Table of Contents

The 2 principal forms of bank cards are secured and unsecured. There are such a lot of completely different classes of unsecured playing cards.

Secured bank cards are designed that will help you construct credit score, whether or not you’ve got poor credit score or no credit score in any respect. They appear like unsecured playing cards however work in another way.

A secured card isn’t your solely choice in the event you’re nonetheless constructing credit score, but it surely may be your finest. Unsecured playing cards for poor credit score will be expensive and restrictive. However in the end, which kind of card is best for you relies on your historical past and credit score use.

Let’s check out the variations between secured vs. unsecured bank cards now.

What’s Forward:

Variations Between a Secured and Unsecured Credit score Card

| Secured bank cards | Unsecured bank cards | |

|---|---|---|

| Deposit | Sure | No |

| Credit score restrict | Low, or primarily based on deposit | Varies, primarily based on credit score |

| Credit score rating to qualify | Scores under 579 (or no credit score in any respect) can qualify | Sometimes scores over 670 |

| Typical/common APR | 16%, however will be MUCH greater | 16% |

| Annual charges | Normally | Typically |

| Helps to construct credit score | Sure | Sure |

The primary factor that units secured and unsecured bank cards other than one another is that it’s essential to pay a safety deposit when signing up for a secured card, however you don’t must make a deposit for an unsecured card.

Having to make a deposit to safe a line of credit score makes it fairly simple for anybody to get authorised. It helps you qualify for a secured bank card even in the event you’ve by no means opened a line of credit score earlier than or you’ve got horrible credit.

Bank card firms use the deposit as collateral. This implies your cash is theirs to maintain in the event you’re not in a position to repay your card. However after you’ve made the deposit, a secured card works like some other bank card.

Each secured and unsecured card issuers report your fee historical past to the three main shopper credit score bureaus. This enables secured card customers to enhance their credit score with common use and reimbursement. With a yr of on-time funds, many secured card customers can get authorised for the standard, unsecured card.

That’s to not say you possibly can’t get an unsecured bank card when you’ve got poor or no credit score. Lots of people go straight to an unsecured card, however they may find yourself paying extra in charges than they should. That will help you resolve whether or not a secured or unsecured card is best for you, check out the options of every.

How a Secured Card Works

If somebody gave you $200 to carry on to, would you mortgage them $200? In the event you’re already holding their cash, there’d be no danger in your half in the event you did. That is primarily what banks are doing after they provide secured playing cards. Let’s have a look at a number of the key options of a secured bank card.

You Pay a Safety Deposit

Again to that safety deposit. Candidates for secured bank cards should submit a refundable safety deposit earlier than their account is authorised. The cardboard issuer holds onto this cash however solely retains it if the cardholder repeatedly fails to make funds. That is also called defaulting.

In the event you can’t pay your invoice, you lose the deposit. In the event you do make all of your funds on time, you’ll get the deposit again in the event you ever shut the account.

With a secured bank card, your safety deposit often turns into your credit score line. So in the event you make a $500 deposit, you may be authorised for a credit score line of $500.

You Nonetheless Have to Make Funds

A secured bank card acts precisely like a bank card, and that goes for the way you pay it too. We at all times advocate paying your stability in full every month to start out constructing your credit score safely. In the event you’re ever late on a fee, you’re going to get charged a charge and this may present up as a unfavorable mark in your credit score.

Simply as with all different bank card, secured card customers obtain an announcement every month that features the due date. Most secured playing cards even have a grace interval that offers additional time between when the billing cycle ends and when your fee is due that will help you keep away from costs. Alternatively, secured cardholders might select to hold a stability and pay curiosity.

In the event you do get a secured bank card, it’s vital to know that your deposit just isn’t used to make funds.

Your Credit score Line Would possibly Be Decrease

Each secured and unsecured bank cards are revolving traces of credit score, that means you possibly can borrow as much as your credit score restrict every month so long as you’re paying off your debt. However secured playing cards often have smaller credit score traces than unsecured bank cards as a result of your borrowing restrict is usually set by your deposit.

It Helps You Construct Credit score

Utilizing a secured bank card is a superb manner for people who find themselves both new to credit score or rebuilding their credit score as a result of funds are reported to the bureaus. The extra full funds you make on time, the higher your credit score will likely be.

Associated: Construct Credit score the Proper Method

You Can Graduate to an Unsecured Card

Most secured bank cards have a program that allows you to graduate to an unsecured bank card.

Right here’s how this works. After a set variety of on-time funds in your credit score report, many secured bank card firms provide the choice to open an unsecured bank card and even transition your current secured card. This implies getting your deposit again and possibly a credit score line enhance.

It’s a Nice Solution to Be taught Monetary Duty

Secured bank cards make nice first playing cards for younger adults as a result of they train good bank card habits. As a result of your credit score line is small, the danger is comparatively low, and it will get you used to swiping a bank card and making a fee each single month.

As you show you’re able to handle your credit score, you possibly can transfer on to an unsecured bank card.

Associated: How To Set up Credit score When You Are Simply Getting into Maturity & Why You Ought to

How an Unsecured Card Works

With no safety deposit required, you qualify for an unsecured card primarily based in your creditworthiness. It is a metric banks use to resolve how dangerous it’s to mortgage cash to you. Listed below are some particulars you’ll need to find out about unsecured playing cards.

It Isn’t Secured In opposition to Something

An unsecured bank card isn’t secured in opposition to any kind of collateral. Your credit score restrict is set by elements like revenue and credit score rating as a substitute of how a lot you deposit.

There isn’t any collateral in opposition to the credit score line with an unsecured bank card, so the bank card supplier is taking a calculated danger assuming you’re going to make funds on the bank card and in the end pay the stability again.

In the event you default on the stability or miss funds, the bank card supplier has the correct to cost late charges or accumulate the stability from you, and it’ll hurt your credit score rating.

Your Credit score Line Would possibly Be Greater

An unsecured credit score line helps you construct credit score shortly. You’ll typically get a bigger credit score restrict than you’ll with a secured card, which can provide you a greater credit score utilization ratio. That is the ratio of the cash you borrow to the amount of cash you’re allowed to borrow.

Retaining your credit score utilization ratio, additionally referred to as your debt-to-credit ratio, under 30% is good, and lots simpler to do with greater credit score limits.

For instance, in case your credit score restrict is $5,000 and also you constantly use and pay again lower than $1,500 every month, you’ll doubtless be authorised for brand new credit score – and possibly much more credit score – sooner or later. The longer you preserve a great credit score utilization ratio, the stronger your credit score will likely be.

Why You Would Get a Secured Credit score Card

So, must you select a secured bank card or an unsecured bank card?

A secured bank card would make sense for you in the event you had been model new to credit score. It’s a secure, low-risk manner to determine what you’re doing and construct your credit score when you study. That is additionally a wise choice for anybody who’s digging their manner out of credit score bother.

It’ll take longer so that you can enhance your credit score with a secured card, however be affected person and also you’ll see progress.

With a secured bank card, you danger shedding your safety deposit and might harm your credit score with late funds. Simply bear in mind this when selecting between secured vs. unsecured bank cards and know that whichever choice you select could have long-term impacts.

Why You Would Get an Unsecured Credit score Card

An unsecured bank card would make sense for you when you’ve got some credit score historical past. There are much more unsecured bank cards to select from, making this a more sensible choice in the event you’re searching for flexibility. Many even allow you to earn rewards if you spend cash in qualifying service provider classes.

Unsecured bank cards additionally provide greater credit score limits, permitting you to make bigger purchases together with your card. However with this comes the danger of taking over extra debt. Plus, unsecured bank cards are more durable to qualify for. Most require a credit score rating of a minimum of 670 for approval, so this isn’t a great choice to your first-ever card or in case your credit score could be very poor.

Look out for charges as nicely and do not forget that the charges you pay for unsecured playing cards are at all times non-refundable.

Associated: What Credit score Rating Do You Have to Get Authorized for a Credit score Card?

Finest Secured Playing cards for Constructing Credit score

OpenSky® Secured Visa® Credit score Card

The OpenSky® Secured Visa® Credit score Card is a superb choice for people who find themselves simply beginning their credit score profile or are working to rebuild it. One of many nice options of OpenSky is that they consider everybody ought to have a possibility to construct their credit score, so there isn’t a credit score examine required to use for the cardboard. Plus, you received’t wait weeks to search out out in the event you’re authorised. OpenSky will provide you with an instantaneous determination.

You select how a lot you need to deposit between $200 and $3,000. This accretion is totally refundable. OpenSky experiences your exercise to all three main credit score reporting businesses.

One of many different nice options of this card is the Fb neighborhood for different OpenSky card members to share their progress or ask questions on credit score.

There’s an annual charge of $35 and also you don’t earn rewards. The APR is 21.89% (Variable) and the money advance APR is 21.89% (Variable). Lastly, there’s a 3% overseas transaction charge.

Be taught extra in regards to the OpenSky® Secured Visa® Credit score Card.

Capital One Platinum Secured Credit score Card

The Capital One Platinum Secured Credit score Card is one other wonderful choice for rebuilding your credit score with a secured card.

There’s a required (refundable) safety deposit of both $49, $99, or $200, however that deposit quantity just isn’t essentially equal to your restrict. The beginning credit score line is $200 for all customers, however the higher your credit score, the decrease the deposit you will want to make. It’s also possible to make a bigger deposit to unlock a better restrict. This card does require a credit score examine.

Capital One performs common credit score line critiques on this card, so that you’re routinely thought-about for a better credit score line in as little as six months. Capital One will even monitor your account to find out in the event you qualify to improve to an unsecured Platinum card and get your deposit again.

The capital One Platinum Secured Credit score Card comes with some extra options like safety alerts from Eno, Capital One’s digital assistant. Eno will notify you of suspicious exercise as quickly because it occurs.

There isn’t any annual charge however the rate of interest is on the excessive finish at 29.74% (Variable).

Be taught extra in regards to the Platinum Secured Credit score Card from Capital One.

Citi Secured Mastercard

The Citi® Secured Mastercard® is among the most beginner-friendly secured bank cards on the market. With options like Versatile Fee Due Dates and no annual charge, this card is a strong alternative for newbies and anybody who desires to get it proper with their credit score.

This card gives a credit score restrict of between $200 and $2,500. Your restrict will likely be equal to no matter deposit you make.

This Citi® Secured Mastercard® costs no annual charge or hidden charges and gives a decrease on a regular basis APR of 26.74% (Variable). If there’s a likelihood you will want to hold a stability, think about this card earlier than the others. Sometimes, secured bank cards have a lot greater rates of interest.

Utilizing the Citi app, you possibly can examine your FICO credit score rating at any time (with out affecting your credit score) to see how it’s enhancing.

Be taught extra in regards to the Citi® Secured Mastercard®.

Finest Unsecured Playing cards for Poor or Honest Credit score

In case your credit score is poor to honest, a secured bank card might be your most secure choice. That being stated, there are unsecured bank cards you possibly can qualify for with horrible credit. Find out about a number of the prime choices under.

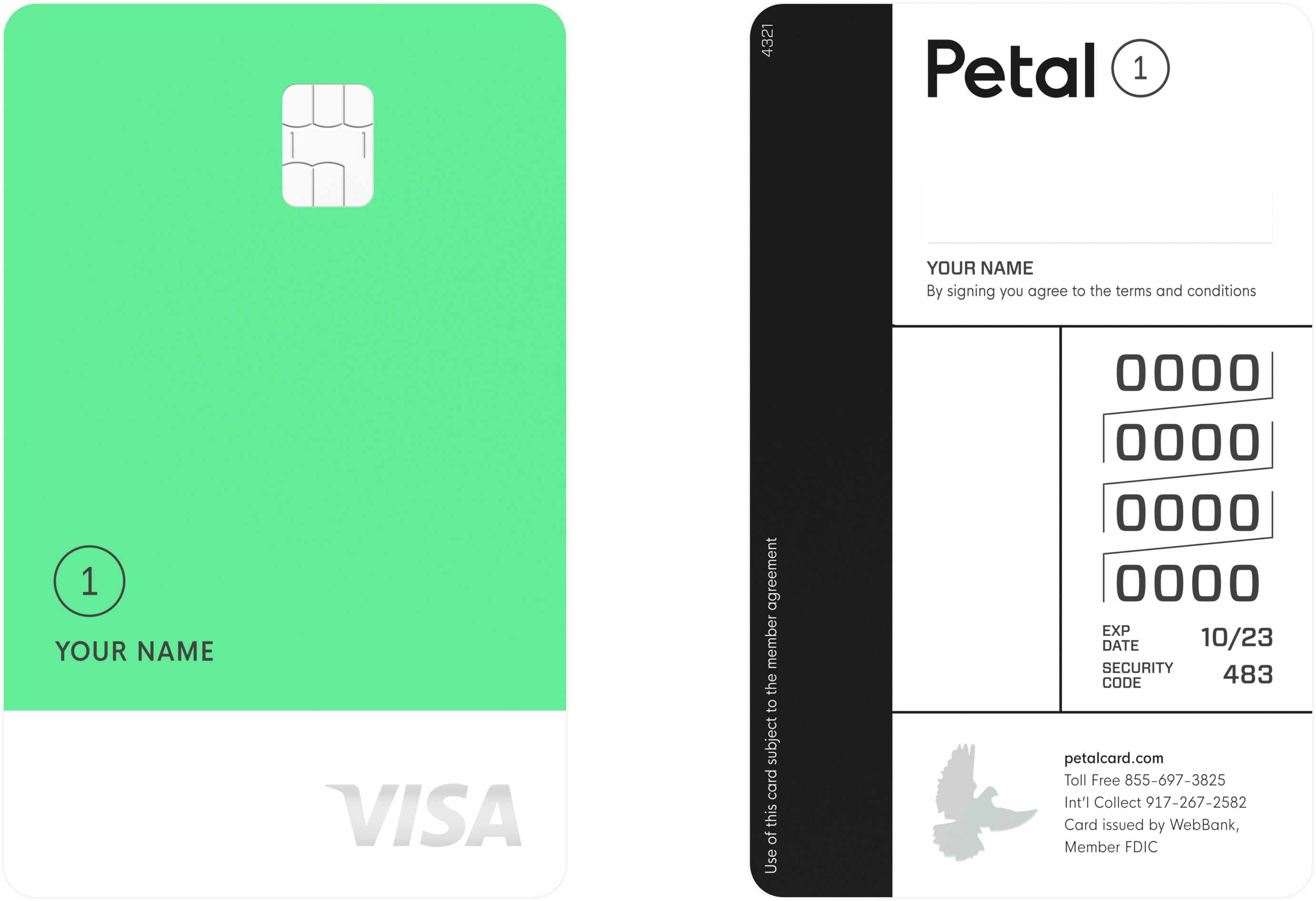

Petal® 1 “No Annual Charge” Visa® Credit score Card

The Petal® 1 “No Annual Charge” Visa® Credit score Card has considered one of its principal perks proper within the title. With no annual charge, this unsecured bank card for debtors with no or restricted credit score received’t break the financial institution like some playing cards on the market. There are additionally no overseas transaction charges or charges for exceeding your restrict.

Credit score limits for this bank card vary from $300 to $5,000. $5,000 is fairly beneficiant for a newbie’s unsecured card, making this an ideal choice for anybody who plans to place a number of spend on their card (and, hopefully, pay it again on time every month).

One other factor to like about this card is the money again. You possibly can earn between 2% and 10% again in your purchases at taking part retailers, which is basically aggressive for a card that’s fairly simple to qualify for. Money again will be redeemed as credit towards your stability.

You don’t want a credit score rating to be authorised. In the event you’re making use of for the primary time, you’ll obtain a Money Rating, which is principally Petal’s personal manner of displaying you ways creditworthy you’re. You possibly can see in the event you’re pre-approved from the positioning or cell app with out affecting your credit score.

Be taught extra in regards to the Petal® 1 “No Annual Charge” Visa® Credit score Card.

Capital One QuicksilverOne Money Rewards Credit score Card

The Capital One QuicksilverOne Money Rewards Credit score Card is a improbable alternative for individuals with honest credit score.

You earn limitless 1.5% money again on each buy you make and also you don’t must choose into any rotating classes. There isn’t any cap on how a lot you possibly can earn and your rewards by no means expire.

There’s no overseas transaction charge, and you’ll be routinely thought-about for a better credit score line in as little as six months.

On the draw back, the cardboard does include a $39 annual charge, and the common buy APR is comparatively excessive at 29.74% (Variable). All the time keep away from carrying a stability when you possibly can.

Be taught extra in regards to the Capital One QuicksilverOne Money Rewards Credit score Card.

Indigo® Mastercard® Credit score Card

The Indigo® Mastercard® is designed particularly for horrible credit. In the event you’re set on an unsecured card however your credit score isn’t nice, the Indigo® Mastercard® is a reasonably good choice.

Primarily based in your creditworthiness, you might or might not pay an annual charge for this card. The attainable charges are between $0 – $99. The bank card’s buy price is 24.9% APR. For a card designed to construct credit score, that’s not too dangerous.

The credit score restrict on this card solely goes as much as $300, and Indigo deducts the annual charge out of your credit score line. So in the event you qualify for the $300 credit score line and your annual charge is $59, your credit score restrict might begin at $241. It wouldn’t harm to maintain your spending at a minimal anyway, however you would possibly discover this restrictive.

You possibly can pre-qualify for this card earlier than making use of and going by a credit score examine. Simply go to the web site and fill out some fundamental info to see in the event you’re authorised.

Be taught extra in regards to the Indigo® Mastercard® Credit score Card.

Abstract

The query of whether or not you need to get a secured vs. unsecured bank card actually comes right down to how a lot danger you’re keen to take and the way a lot expertise you’ve got with credit score.

Secured bank cards require a safety deposit, however they provide the most secure option to construct or rebuild your credit score by making month-to-month on-time funds. Unsecured playing cards, for these with lower than excellent credit score, are usually riskier however can provide advantages like rewards and decrease annual charges and rates of interest.

Each might help you construct credit score from scratch or enhance your rating with common, on-time funds every month.

Learn Extra:

- How To Enhance Your Credit score Rating, Step By Step

- Finest Credit score Playing cards If Your FICO Rating Is Between 600 and 649