Table of Contents

Currently, I’ve been seeing the outdated “marry the home, date the speed” adage thrown round quite a bit.

The concept is comparatively simple. You purchase a house you actually need, no matter accessible financing phrases.

And the mortgage price you obtain, even when excessive right this moment, isn’t your eternally price as a result of you may all the time refinance down the highway.

However is it actually that straightforward? And does the entire thing hinge on rates of interest being extra favorable sooner or later?

What if you wish to divorce the home? However you’re too afraid to go away that low price behind?

Marry the Home. Like for Without end?

Let’s dissect the time period by breaking it down into its two sections. First, we’ll talk about the “marry the home” piece.

Lots of of us purchase a selected piece of property as a result of they fall in love with it. It’s usually emotional.

There’s additionally a presumption that many individuals purchase a eternally residence that they plan to maintain, effectively, eternally.

Merely put, they plan to remain within the property for the lengthy haul, and as such are basically marrying the factor.

In spite of everything, a wedding is anticipated to persist, not simply final a yr or two.

In actuality, we all know this isn’t the case, however the intention is there, regardless of what might transpire after the marriage day.

Finally look, the typical tenure for an American house owner was 13.2 years, per the Nationwide Affiliation of Realtors (NAR).

This was for the yr 2021, a slight dip from 13.5 in 2020, however effectively above “historic requirements.”

Again in 2012, it was simply 10.1 years, and earlier than that it was even decrease, typically simply six years.

So are Individuals actually marrying their properties, or long-term courting them?

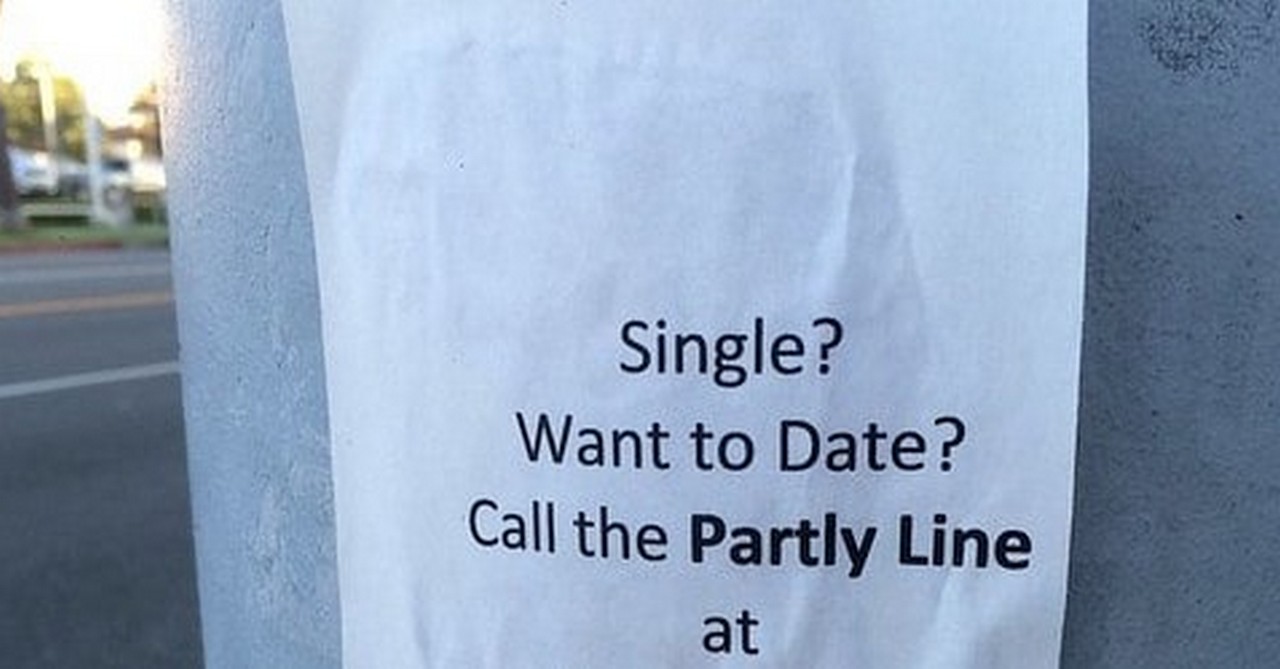

Date the Price (However Hold In search of Higher)

Now let’s incorporate that second piece, “date the speed.” Because the saying suggests, your financing will be momentary, much like your final date.

You don’t need to hold the identical residence mortgage, even for those who hold the home.

Assuming there isn’t a prepayment penalty, you might be overtly in a position to refinance your mortgage at just about any time.

For instance, for those who purchased a house in 2008 when 30-year fastened mortgage charges averaged round 6%, you might need refinanced into a brand new 30-year mortgage at 3-4% a couple of years later.

And you will have refinanced once more a couple of years after that when mortgage charges hit file lows, dropping into the mid-2% vary.

In different phrases, not staying trustworthy to your authentic residence mortgage or your mortgage lender/servicer.

And why would you if rates of interest drop by 50%?

This Idiom Usually Surfaces When Mortgage Charges Are Excessive…

The saying “marry the home, date the speed” makes a number of sense in hindsight, after mortgage charges have fallen considerably.

Nevertheless it typically doesn’t floor till mortgage charges are “excessive,” no less than relative to what they’d been not too long ago.

The phrase basically exists to minimize the blow of a excessive(er) mortgage price. To take consideration away from it and give attention to the emotional piece of shopping for a house.

You actually love that residence, you need that residence, so who cares what mortgage charges are?

There’ll all the time be a time to refinance sooner or later as soon as mortgage charges go down once more.

And that’s type of the kicker. What if rates of interest don’t go down? What for those who’re not in a position to refinance since you don’t qualify for a mortgage sooner or later?

There are a number of what ifs to think about. There’s additionally the truth that your buy worth drives each the down cost requirement and the property tax foundation.

So whilst you would possibly be capable of date your mortgage price, then dump it sooner or later, it received’t change how a lot you wanted to place down based mostly on the acquisition worth.

Or what you pay in annual property taxes, barring a positive evaluation sooner or later if costs come down.

So actually, we’re speaking about courting with the expectation that you just’ll discover a higher date sooner or later.

This isn’t all the time the case and it’s certainly not a assure.

If You’re Courting Your Price, Why Not Take Out an ARM?

Now for those who’re actually shopping for into the marry the home, date the speed argument, shouldn’t you’re taking out an adjustable-rate mortgage (ARM).

In spite of everything, it’s going to provide a considerably decrease rate of interest than a 30-year fastened (the one).

ARMs are principally hybrids as of late with lengthy intervals of fixed-rate goodness (5/1 ARM or 7/1 ARM), that means you may date your price for period of time earlier than searching for a brand new date.

Courting for 5 or seven years looks as if an ample time period, doesn’t it?

After that, and even throughout that interval, you may transfer on so to talk, assuming rates of interest enhance.

You would possibly be capable of transfer into one thing extra everlasting, like a 30-year or 15-year fastened mortgage.

Why go together with the eternally mortgage for those who’re not that severe to start with? Would possibly as effectively have some enjoyable with the ARM whilst you’re nonetheless testing the waters.

If you happen to’re not searching for a severe dedication, why become involved with a 30-year fastened? Particularly one it’s important to pay a premium for?

To sum issues up, the phrase does present alternative to take a tougher have a look at the intersection of mortgage and homeownership, regardless of the saying’s apparent flaws.

In case you are a potential residence purchaser, it is very important think about each the acquisition worth and the financing accessible now and sooner or later.

However you shouldn’t essentially put extra weight into one or the opposite, as issues don’t all the time end up as they appear.

The irony right this moment is many householders most likely wish to keep married to their ultra-low mortgage price, however ditch the home.