Table of Contents

With speedy factors accumulation — however extraordinarily limiting redemption choices and restrictions — the My GM Rewards Card™️ appeals to a distinct segment group of GM loyalists who’re each a) saving up for a brand new GM automobile and b) making loads of GM-related purchases alongside the way in which.

What We Like:

-

Earn 15,000 bonus factors after you spend $1,000 in your first three months – that’s $150 in worth if you redeem with GM

-

Earn 4x and 7x rewards towards your subsequent GM buy

-

No annual payment

Intro APR Purchases

0%

Intro Time period Purchases

12 Months

Intro APR Stability Transfers

N/A

Intro Time period Stability Transfers

N/A

Common APR

19.49% to 29.49% Variable, based mostly on creditworthiness

Annual Price

$0

- Earn 15,000 bonus factors after you spend $1,000 in your first three months – that is $150 in worth if you redeem with GM

- Earn 4x factors for each $1 spent all over the place, and obtain limitless 7x complete factors for each $1 spent with GM. Factors do not expire so long as your account stays open

- Factors add up quick! For instance, spending $12K per yr on on a regular basis purchases will earn 48,000 pts which is $480 in worth towards future redemptions with GM

- On the lookout for a brand new GM automobile? Redeem limitless factors in the direction of the acquisition or lease of a brand new Chevrolet, Buick, GMC or Cadillac

- Already personal or lease a GM automobile? Use your factors towards your mortgage or lease cost with GM Monetary, Licensed Service, eligible Equipment and extra

- No annual payment, no overseas transaction charges, or money advance charges. Late charges could apply

- 0% intro APR on purchases for the primary 12 months, then a variable APR of 19.49% to 29.49%

- See in case you’re accredited with no affect to your credit score rating. Accepting a card after your utility is accredited will lead to a tough inquiry, which can affect your credit score rating

- Phrases Apply. Topic to credit score approval

- *Charges and Phrases and Profit Phrases.

Editor’s Be aware – You’ll be able to belief the integrity of our balanced, impartial monetary recommendation. We could, nonetheless, obtain compensation from the issuers of some merchandise talked about on this article. Opinions are the writer’s alone. This content material has not been offered by, reviewed, accredited or endorsed by any advertiser, except in any other case famous beneath.

In case you’re saving up for a brand new automobile, will an automaker’s bespoke rewards card assist you to get there quicker?

It definitely appears that manner; the My GM Rewards Card™ affords a whopping 4x again on all purchases, plus 7x again on GM companies, components, and equipment.

Even in case you don’t have a Camaro or a Cadillac to service but, 4x remains to be a heckuva entire lot. Plus, the cardboard has no annual payment, a $150 sign-up bonus, and as much as $150 price of annual assertion credit.

So what’s the catch? Let’s examine.

Key Options

- Earn charges: 7x factors per $1 spent on choose GM purchases; 4x factors per $1 spent on all the pieces else

- Welcome supply: 15,000 factors after spending $1,000 throughout the first three months

- Redemption worth: Factors price $0.01 every when utilized to GM merchandise, automobiles, and companies; $0.0025 every when redeemed for present playing cards

- Assertion credit and further reductions: As much as $150 in annual assertion credit and reductions for gasoline and automobile detailing

- Further advantages: Cardholders robotically qualify for My GM Rewards Gold Tier standing and World Elite Mastercard advantages

- Intro APR: 0% APR for the primary 12 Months on new purchases. Then the continued charge of 19.49% to 29.49% Variable, based mostly on creditworthiness applies.

- Annual payment: None

In-Depth Evaluation

Earn Charges

Simply probably the most eye-popping characteristic of the My GM Rewards Card™ is the flexibility to earn no less than 4x factors on all the pieces you purchase.

Yep; whether or not it’s fuel, groceries, even a Ford Mustang keychain — doesn’t matter, you’ll earn 4x factors on it.

Customized meme generated utilizing imgflip.com. IP Supply: The Oprah Winfrey Community

On high of that, you’ll earn a powerful 7x factors on all eligible GM purchases, together with companies, components and equipment bought at collaborating My GM Rewards Card™ dealerships or on-line.

I couldn’t discover a checklist of “collaborating” dealerships on-line, however to not concern — I known as round, and three separate GM gross sales managers advised me they’ve by no means heard of a GM supplier not collaborating in My GM Rewards.

Redemptions

My GM Rewards factors can solely be redeemed for his or her full worth ($0.01 every) when utilized to a GM buy. That checklist consists of:

- Buy or lease of an eligible new GM automobile

- Buy of an eligible Licensed Pre-Owned GM automobile

- GM Licensed Service, GM Equipment, or GM Real Elements and ACDelco components bought at a collaborating GM dealership

- Choose OnStar®, SiriusXM, and GM Linked Companies Plans

- GM Automobile Safety Plans

There are additionally limits on what number of factors you may convert inside every class in a single calendar yr.

Lastly, outdoors of GM merchandise, you may convert factors to present playing cards — however at a lack of 75% of their most worth ($0.025 every).

Right here’s’ a full breakdown:

| Redemption choice | Redemption worth | Most redemption quantity | Exceptions |

|---|---|---|---|

| Buy or lease of an eligible new GM automobile | $0.01 | Limitless | Fleet automobiles, GM Worker Reductions, GM Firm-Owned Automobile Low cost, Provider Low cost, another affords |

| Buy of an eligible Licensed Pre-Owned GM automobile | $0.01 | $1,000 per calendar yr | Fleet automobiles, GM Worker Reductions, GM Firm-Owned Automobile Low cost, Provider Low cost, another affords |

| Licensed GM companies, components, and equipment; OnStar and Linked Service plans and SiriusXM subscriptions; Automobile Safety Plans | $0.01 | $250 per calendar yr | None listed |

| Present playing cards to numerous shops, eating places, and retailers | $0.0025 | $250 per calendar yr | None listed |

If you wish to get any significant worth out of your My GM Rewards factors, you may basically solely redeem them for GM merchandise. Even then, there are low ceilings on how a lot you may redeem directly.

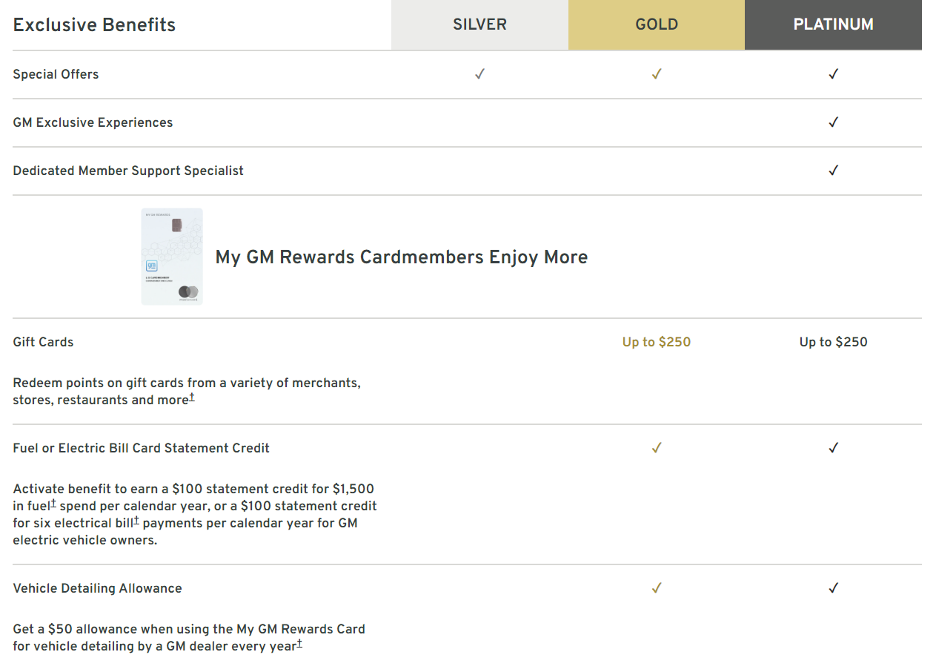

Gas/EV Assertion Credit and Automobile Detailing Low cost

The cardboard begins to look loads higher if you consider some bonus assertion credit.

For starters, there are two methods you will get the $100 “gasoline” assertion credit score:

- Spend $1,500 on fuel in a calendar yr, or

- Because the proprietor of a GM electrical automobile, use your My GM Rewards Card™ to pay for six months of electrical payments.

A $100 gasoline credit score is kind of a considerable draw for many who meet both of the above circumstances. In case you spend $1,500 on fuel in a given yr, the gasoline credit score is equal to almost 7% money again on that spending. That’s very aggressive with the most effective fuel playing cards on the market.

The My GM Rewards Card™ additionally features a $50 “allowance” towards a automobile detailing service at a collaborating GM supplier. For reference, fundamental washes and particulars have a tendency to begin at $25 and $125, respectively.

Charges and Curiosity Charges

The My GM Rewards Card™ affords 0% APR for the primary 12 Months on new purchases, and fees no annual payment.

It additionally fees no charges for transfers, stability transfers, overseas transactions, or money advances.

In truth, about the one payment this card fees past its common, variable APR is a late cost payment of as much as $40.

For extra playing cards that assist you to keep away from charges, try our lists of the Finest No Annual Price Credit score Playing cards and the Finest Credit score Playing cards For Worldwide Journey.

My GM Rewards Gold Tier Advantages

When you obtain your My GM Rewards Card™ and enroll in My GM Rewards, you’re robotically elevated to Gold Tier standing.

Curiously, whereas that is touted as a perk, My GM Rewards Cardholders have already got all of the bonuses of Gold Tier standing — and extra. Enrolling doesn’t appear to get you something additional, besides one step nearer to Platinum standing which provides GM Unique Experiences and a Devoted Member Help Specialist.

World Elite Mastercard advantages

For the reason that My GM Rewards Card™ is a World Elite Mastercard, you’ll achieve immediate entry to a set of money-saving advantages like:

- $5 in Lyft credit score for each three rides taken per 30 days

- Three months of free DoorDash DashPass plus $5 low cost in your first two orders every month

- Complimentary ShopRunner membership

- Complimentary grounds passes for PGA Tournaments

And extra. You’ll be able to try the complete checklist of World Elite Mastercard advantages right here.

Execs and Cons

Execs

-

Rewards charges — Earn as much as 7x factors to use towards your subsequent GM buy.

-

Welcome supply — Spend $1,000 inside three months and also you’ll get $150 towards your subsequent GM buy.

-

Assertion credit — Earn $100 again on $1,500 of gasoline purchases or six months of electrical payments for GM EV house owners, plus $50 towards an auto element on the supplier.

-

World Elite Mastercard advantages — Features a free DashPass for 3 months, PGA Match passes, and extra.

-

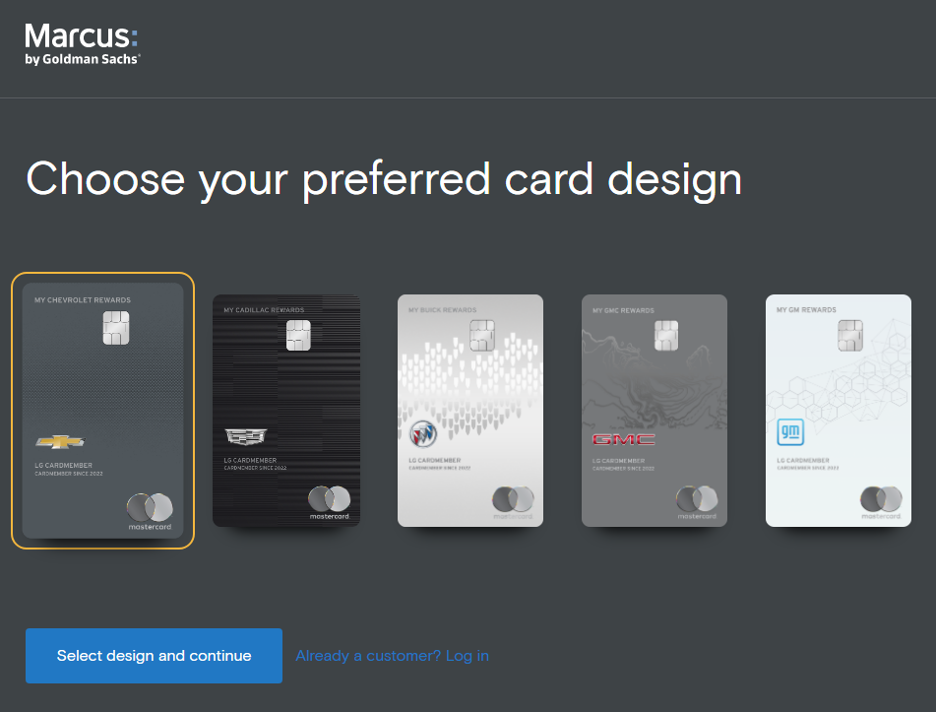

Slick GM-themed card design — You’ll be able to select from GM, Chevy, Buick, Cadillac, or GMC-themed card designs.

Cons

-

Restricted redemption choices — GM purchases are principally your solely redemption choice if you need affordable worth in your factors.

-

Can’t mix factors with GM incentives — My GM Rewards factors can’t be mixed with an worker low cost, provider low cost, or different buy incentives.

-

Low redemption caps — You’ll be able to solely redeem $1,000 price of factors towards a Licensed Pre-Owned Automobile and $250 towards different GM services or products each calendar yr.

My GM Rewards Card™ In contrast

Let’s say you’re saving as much as purchase a Chevy Silverado subsequent yr.

Which card will assist you to earn probably the most money again to use towards your truck buy?

| My GM Rewards Card™ | Citi Customized Money℠ Card | Chase Sapphire Most popular® Card | |

|---|---|---|---|

| Annual payment | $0 | $0 | $95 |

| Rewards charges | 7x on eligible GM purchases; 4x all different purchases | 5% in high eligible spend class; 1% all over the place else | 5x on journey bought via Chase; 3x on eating, eating places, on-line grocery purchases, and streaming companies; 2x on non-Chase journey; 1x on all different purchases |

| Signal-up bonus | 15,000 factors after spending $1,000 inside 3 months | $200 money again after making $1,500 in purchases within the first 6 months | 60,000 bonus factors after you spend $4,000 on purchases within the first 3 months from account opening. That is $750 towards journey when redeemed via Chase Final Rewards®. |

| Assertion credit and different bonuses | $100 after spending $1,500 on gasoline or paying 6 electrical energy payments; $50 towards detailing service at GM supplier | N/A | $50 annual Lodge Credit score; 10% anniversary factors increase at yr’s finish |

| Different notable perks | World Elite Mastercard advantages | Add Licensed Customers free and earn factors on purchases they make | Break up massive purchases into zero-interest month-to-month funds |

My GM Rewards Card™ vs. Citi Customized Money℠ Card

It’s exhausting to beat the My GM Rewards Card’s 4x factors ‘flat’ earn charge, i.e. the minimal variety of factors it earns for any buy. However the Citi Customized Money℠ Card is unquestionably aggressive with its distinctive accelerated earn charge: The cardboard dishes out 5% money again in your high spending class every month, which may be groceries, fuel, journey, and many others. in a given month relying in your spending habits.

Granted, the 5% charge solely applies to the primary $500 spent in that class every billing cycle ($25 in money again). Provided that the Citi Customized Money℠ Card doesn’t have an annual payment, you would possibly truly select to make use of it together with the GM Rewards Card™, placing the primary $500 spent in a given class on the Citi card after which shifting your spending to the GM Rewards Card™ till a brand new month begins.

Take a look at our full evaluate of the Citi Customized Money℠ Card

Card information has been collected by MoneyUnder30 to assist shoppers higher evaluate playing cards. The monetary establishment didn’t present or approve card particulars.

My GM Rewards Card™ vs. Chase Sapphire Most popular®

How does the My GM Rewards Card™ evaluate to a card with an annual payment, however a a lot larger sign-up bonus?

Chase Sapphire Most popular® Card awards you with 60,000 bonus factors after you spend $4,000 on purchases within the first 3 months from account opening. That is $750 towards journey when redeemed via Chase Final Rewards®.

By comparability, the My GM Rewards Card™ has a extra modest $150 sign-up bonus — nevertheless it accumulates factors a lot quicker. To make up the distinction within the sign-up bonus values, you’d must make about $9,000 in purchases within the My GM Rewards Card’s 4x factors class (non-GM purchases).

So, offered you might have wonderful credit score and qualify, within the quick time period you would possibly truly pocket more cash towards the acquisition of a brand new automobile by utilizing a paid, top-tier rewards card with an enormous sign-up bonus, just like the CSP.

Take a look at our full evaluate of the Chase Sapphire Most popular® Card or apply for the cardboard right this moment.

Who Ought to Apply for the My GM Rewards Card™?

The My GM Rewards Card™’s distinctive limitations and restrictions make it interesting to a really slim area of interest.

In case you’re already spending 1000’s yearly on eligible GM purchases and plan to buy a GM new or Licensed Pre-owned automobile within the close to future, the cardboard is smart. At that time, you’d be incomes factors quicker than you’ll with a number one, basic goal rewards card.

It may additionally make sense as a backup/emergency bank card that you simply solely use when servicing your present GM automobile. Simply remember that your My GM Rewards factors are solely redeemable for $0.01 when utilized to future GM purchases.

The best way to Apply for the My GM Rewards Card™

Your first step in making use of for the My GM Rewards Card™ is to make sure you have a excessive sufficient credit score rating — round 700 or so.

To its immense credit score, the My GM Rewards Card™ truly permits you to view your eligibility with out making a tough credit score verify — also called a smooth pull.

Even nonetheless, it can save you time by checking your rating first. You will get a free credit score report from our mates at Credit score Karma and in case you need assistance getting your numbers up, try our article: How To Enhance Your Credit score Rating, Step By Step.

The next move is a enjoyable one — decide a design:

Subsequent, you’ll fill out an ordinary bank card app. You’ll share your fundamental contact information, SSN, revenue, and extra.

In case you’d like assist or are simply curious why bank card corporations must ask these items, try our guides on The best way to Apply for a Credit score Card and What You Must Know About Making use of for a Credit score Card with a Restricted Earnings.

Whereas your card is within the mail for between 5 and ten enterprise days, go forward and enroll in My GM Rewards, too. You’ll want it to maximise your advantages.

Lastly, in case you’re treating your My GM Rewards Card™ as a spare/backup card, simply be certain you place $1,000 on it inside three months to set off your $150 bonus!

Abstract

The My GM Rewards Card™ makes probably the most sense in case you’re already spending 1000’s a yr on GM automobiles, companies, and equipment — and plan to purchase extra GM automobiles sooner or later. Regardless of the mass attraction of 4x again on each buy, it’s actually only a area of interest card for GM loyalists.