Table of Contents

College students will love the simplicity of this money again bank card from Capital One. Earn a limiteless 1.5% money again on each buy, daily, and your rewards gained’t expire for the lifetime of the account. Plus there’s no annual payment, overseas transaction charges, or different hidden charges to fret about.

What We Like:

-

Early Spend Bonus: Earn $50 once you spend $100 within the first three months

-

Earn limitless 1.5% money again on each buy, daily

-

Get pleasure from no annual payment, overseas transaction charges, or hidden charges

Intro APR Purchases

N/A

Intro Time period Purchases

N/A

Intro APR Steadiness Transfers

N/A

Intro Time period Steadiness Transfers

N/A

Common APR

19.24% – 29.24% (Variable)

Annual Payment

$0

- Earn limitless 1.5% money again on each buy, daily

- Early Spend Bonus: Earn $50 once you spend $100 within the first three months

- Earn 10% money again on purchases made via Uber & Uber Eats, plus complimentary Uber One membership assertion credit via 11/14/2024

- Get pleasure from peace of thoughts with $0 Fraud Legal responsibility so that you just will not be chargeable for unauthorized fees

- Get pleasure from no annual payment, overseas transaction charges, or hidden charges

- Lock your card within the Capital One Cell app if it is misplaced, misplaced or stolen

- Earn as much as $500 a 12 months by referring family and friends once they’re authorized for a Capital One bank card

- Construct your credit score with accountable card use

- Whether or not you are at a 4-year college, neighborhood faculty or different increased schooling establishment, this card may be an possibility for you

Editor’s Observe – You possibly can belief the integrity of our balanced, impartial monetary recommendation. We might, nevertheless, obtain compensation from the issuers of some merchandise talked about on this article. Opinions are the creator’s alone. This content material has not been offered by, reviewed, authorized or endorsed by any advertiser, until in any other case famous under.

The Capital One Quicksilver Scholar Money Rewards Credit score Card is a strong selection for college students however lacks a little bit of firepower to be thought of a robust all-around card.

An all-rounder bank card for college students would supply:

- Low rates of interest.

- Debt safety and credit-building instruments.

- Money again rewards.

- One or two perks.

However curiously, the Capital One QuickSilver Scholar Money Rewards Credit score Card skips proper over letters A and B, and as an alternative piles on C and D.

Cardholders looking for a easy incomes construction will like this card, because it affords a beneficiant 1.5% money again on all purchases, with no annual payment to fret about.

General, all of it is determined by what you’re searching for in your first bank card.

Key info

- Greatest for – College students constructing credit score.

- Signup bonus – Earn $50 once you spend $100 on purchases inside 3 months from account opening

- Money again – Limitless 1.5% money again on each buy.

- Intro APR – N/A.

- Common APR – 19.24% – 29.24% (Variable).

- Perks and distinctive options – Prolonged Guarantee, Grasp RoadAssist® Service® with 24-hour dispatch, Complimentary Concierge Service.

(MU30 disclaimer: the data on perks and distinctive options was independently gathered and reviewed by MU30’s editorial workforce.)

In-depth evaluation of the Capital One Quicksilver Scholar Money Rewards Credit score Card

Let’s take a deep dive into the Capital One Quicksilver Scholar Money Rewards Credit score Card.

Rewards

The Capital One Quicksilver Scholar Money Rewards Credit score Card affords 1.5% money again on all purchases, daily.

That’s it. Clear and easy.

At first, the shortage of rotating spending classes with 5% money again could seem stodgy, however you’ll be hard-pressed to discover a good scholar bank card that provides 5% again on something.

And providing a blanket 1.5% money again on every thing has its benefits, too.

- To start with, it implies that as a busy scholar, you gained’t should preserve monitor of continually rotating rewards classes. I’ve personally felt a mixture of frustration and FOMO once I neglect that I may’ve gotten 5% again on an enormous buy if I’d simply remembered to time the acquisition proper.

- Second, bank card corporations don’t supply 5% money again out of the goodness of their collective hearts. They’re attempting to encourage spending — which isn’t essentially a foul factor, but it surely is problematic once you’re a scholar who’s attempting to stay to a funds, construct credit score, and resist impulsive spending.

That’s why the Capital One Quicksilver Scholar Money Rewards Credit score Card’s 1.5% money again on all purchases is such a great match for college students — it manages to be extremely rewarding with out encouraging non-essential purchases.

Bonuses

For a restricted time, the Capital One Quicksilver Scholar Money Rewards Credit score Card is providing an easy-to-earn signup bonus of $50 once you spend $100 on purchases inside 3 months from account opening.

APR

Relying in your creditworthiness, the Capital One Quicksilver Scholar Money Rewards Credit score Card’s APR might be its largest disadvantage.

The cardboard fees 19.24% – 29.24% (Variable) APR on all purchases. Now, for those who’ve bought an ideal credit score file and might snag the decrease APR, you’re doing properly. However for those who’re simply beginning out in your credit score rating journey, it’s probably you’ll be paying the upper APR.

In case you’re new to bank card APR, right here’s the way it works.

Let’s say you place $1,000 value of fees in your card and are unable to pay it again after 30 days (although you wouldn’t try this as a result of you recognize that you need to repay your bank card steadiness in full each month). Right here’s easy methods to calculate how a lot curiosity you’ll owe (assuming you’re on the high finish of their variable APR):

- Divide your APR by 365, so 0.2524 / 365 = 0.00069.

- Multiply by your steadiness, so 0.069 x $1,000 = $0.69.

- Multiply by days in your billing cycle, so $0.74 x 30 = $20.75.

$20.75 might not sound like a lot, however bank card debt can snowball shortly. That’s why you’ll wish to watch out with the Capital One Quicksilver Scholar Money Rewards Credit score Card for those who’re sitting within the increased APR vary.

Annual payment

The Capital One Quicksilver Scholar Money Rewards Credit score Card fees no annual payment, which is customary amongst student-focused rewards playing cards.

Different charges

Everytime you take into account signing up for a bank card, you’ll wish to familiarize your self not simply with the perks and bonuses, however the charges as properly. In spite of everything, one massive “gotcha” payment can wipe out months of hard-earned money again rewards.

Within the case of the Capital One Quicksilver Scholar Money Rewards Credit score Card, the charges are fairly customary fare.

- Annual payment – $0.

- Steadiness switch payment – $0 at this Switch APR.

- Steadiness switch APR – Varies by cardholder.

- Money advance payment – 3% of the quantity of the money advance, however not lower than $3.

- Late cost payment – As much as $40.

Distinctive perks and advantages

Issues enhance considerably with the Capital One Quicksilver Scholar Money Rewards Credit score Card’s perks and advantages.

In a considerably stunning transfer, Capital One has positively loaded up its scholar rewards playing cards with particular options usually reserved for top-tier playing cards with annual charges.

- No overseas transaction charges. Heading to Paris to fulfill with a pal? Don’t fear about getting nickel-and-dimed for each transaction — like many journey rewards playing cards, the Capital One Quicksilver Scholar Money Rewards Credit score Card doesn’t cost transaction charges for purchases made exterior the U.S.

- Prolonged guarantee. Retailer and producer warranties will mechanically be doubled on eligible purchases for those who used your Capital One Quicksilver Scholar Money Rewards Credit score Card to pay for these purchases (this perk doesn’t apply to vehicles, sadly!).

- Credit score restrict raised after six months. Offered you make on-time funds, you’ll mechanically be thought of for a elevate in your credit score restrict in as little as six months.

- $0 fraud legal responsibility. In case your Capital One Quicksilver Scholar Money Rewards Credit score Card is ever stolen and used to make fraudulent fees, Capital One won’t maintain you accountable for them (simply make sure you report your stolen card ASAP!).

- Autopay. Capital One helps you to arrange autopay so that you by no means miss a full (or minimal) cost in your account. Think about this step to be important!

- Complimentary Concierge Service. Searching for tips about journey, eating, or leisure? You possibly can name up Capital One and get free steering from their 24/7 concierge service.

- 24-hour Journey Help Companies. Grasp RoadAssist® Service® with 24-hour dispatch assist for towing, gasoline supply, and extra.

These perks might not be value a lot every day, however on a very unhealthy day, they are often extraordinarily beneficial.

For instance, in case your $1,000 TV abruptly dies out on you three weeks after the producer’s guarantee expires, to not fear, your Capital One Quicksilver Scholar Money Rewards Credit score Card will cowl the alternative, so long as you used the cardboard to make the TV buy.

How a lot are you able to earn with the Capital One Quicksilver Scholar Money Rewards Credit score Card?

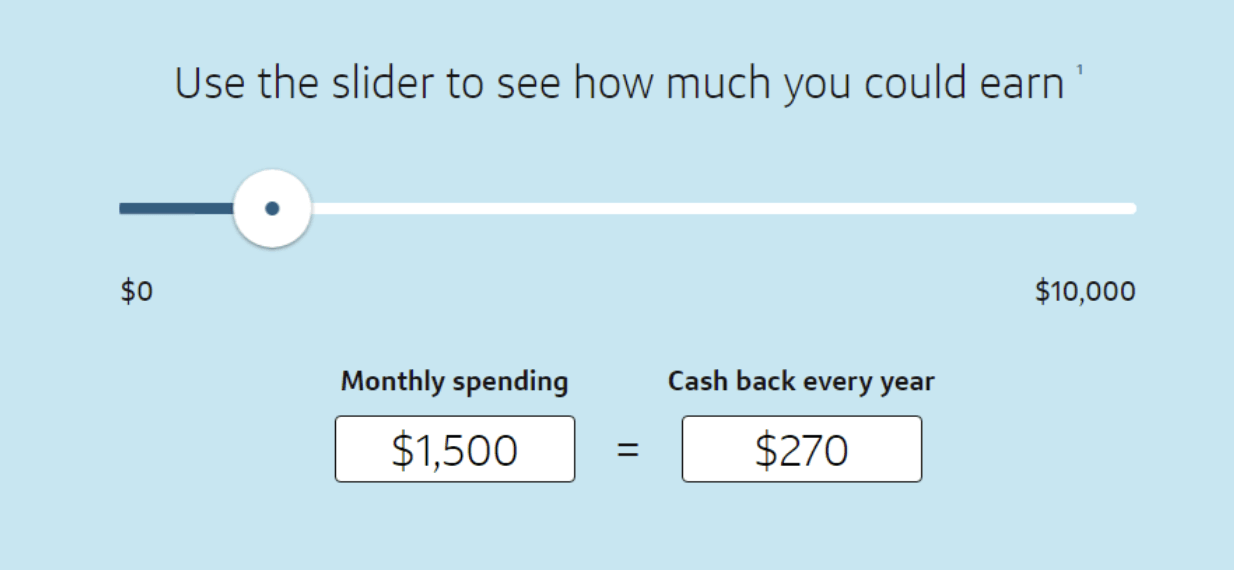

Usually, that is the place I’d present you an enormous chart with numerous spending classes, percentages, and calculate how a lot you possibly can earn in money again relying in your way of life. However the Capital One Quicksilver Scholar Money Rewards Credit score Card’s rewards are so easy you’ll be able to illustrate them with a easy slider.

For instance, for those who spend $1,500 month-to-month, you’ll earn again $22.50 in money again per 30 days or $270 per 12 months.

It’s value mentioning that you just don’t should redeem your factors for money again. You can too convert them to present playing cards, use them to recharge your PayPal steadiness, or apply them to your Amazon purchases at checkout.

Professionals & cons

Professionals

-

Limitless 1.5% money again — The Capital One Quicksilver Scholar Money Rewards Credit score Card affords beneficiant and simple rewards — as an alternative of getting to trace rotating classes, you’ll simply get 1.5% money again on every thing.

-

Accepts honest credit score — The Capital One Quicksilver Scholar Money Rewards Credit score Card accepts honest credit score (620+), which is essential since as a scholar you could have restricted credit score historical past.

-

No annual payment — The Capital One Quicksilver Scholar Money Rewards Credit score Card fees no annual payment, so that you gained’t get a “gotcha” invoice for $95 in a 12 months’s time.

-

Doesn’t encourage nonessential spending — Missing 5% money again on rotating classes might appear to be an omission at first, however their absence discourages pointless spending — which can be extra essential in the long term.

-

Beneficial perks — Perks like Grasp RoadAssist® Service® with 24-hour dispatch and prolonged guarantee could also be value $1,000s on the day it’s important to use them.

-

Credit score monitoring device — Capital One’s free service CreditWise helps you to monitor your credit score rating and get alerts when it adjustments.

Cons

-

No intro APR supply — The Capital One Quicksilver Scholar Money Rewards Credit score Card doesn’t supply 0% APR for any period of time on both new purchases or steadiness transfers, making it unviable for anybody trying to carry over previous debt or doubtlessly create new debt.

-

Likelihood of dangerously excessive APR — 19.24% – 29.24% (Variable) APR from day one is a reasonably threatening incentive to remain out of debt — and doubtlessly catastrophic for those who can’t.

-

No debt security nets — Not like another student-centric rewards playing cards, the Capital One Quicksilver Scholar Money Rewards Credit score Card doesn’t supply younger cardholders instruments or applications to assist them keep out of debt, akin to late cost forgiveness.

Capital One Quicksilver Scholar Money Rewards Credit score Card in contrast

How does the Capital One Quicksilver Scholar Money Rewards Credit score Card stack as much as its closest opponents — together with ones from inside the Capital One steady?

| Capital One QuickSilver Scholar Money Rewards Credit score Card | Capital One SavorOne Scholar Money Rewards Credit score Card | Chase Freedom® Scholar Credit score Card | |

|---|---|---|---|

| Credit score required | Truthful (620+) | Truthful (620+) | Good (690+) |

| Annual payment | $0 | $0 | $0 |

| Intro APR | N/A | N/A | N/A |

| Common APR | 19.24% – 29.24% (Variable) | 19.24% – 29.24% (Variable) | 19.49% Variable |

| Signup bonus | Earn $50 once you spend $100 on purchases inside 3 months from account opening | Earn a $50 bonus once you spend $100 on purchases inside 3 months from account opening | $50 bonus after first buy made inside the first 3 months from account opening |

| Rewards | 1.5% money again on all purchases | 3% money again on eating, leisure, well-liked streaming providers, and at grocery shops, plus 1% on all different purchases, plus 8% on leisure bought via the Capital One Leisure Portal. | 1% money again on all purchases |

| Perks and advantages | Prolonged Guarantee, Grasp RoadAssist® Companies, 24/7 Concierge, and extra | Prolonged Guarantee, Grasp RoadAssist® Companies, 24/7 Concierge, and extra | $20 Good Standing rewards on every anniversary of account opening for as much as 5 years, credit score restrict enhance after making 5 month-to-month on-time funds inside 10 months |

Capital One SavorOne Scholar Money Rewards Credit score Card

$50 bonus once you spend $100 on purchases inside 3 months from account opening shares most of its DNA with its stablemate, the Capital One Quicksilver Scholar Money Rewards Credit score Card. You’ll get the identical APR, similar perks, and similar signup bonus.

The distinction comes within the type of rewards. Moderately than 1.5% money again on every thing, the Capital One SavorOne Scholar Money Rewards Credit score Card affords further rewards (limitless 3%) inside classes that college students are inclined to drop cash in, together with grocery retailer purchases, leisure, and well-liked streaming providers — plus 1% on all different purchases.

Chase Freedom® Scholar bank card

Chase’s counterpart to the Capital One Quicksilver Scholar Money Rewards Credit score Card, the Chase Freedom® Scholar Credit score Card, eschews aggressive rewards for a beneficiant signup bonus.

You’ll get $50 only for making your first buy inside three months, plus a $20 “Good Standing” bonus in your account anniversary for as much as 5 years (so long as you don’t default).

You’ll additionally get 1% again on all purchases, making the Chase Freedom® Scholar bank card a worthy contender within the area.

Do you have to get the Capital One Quicksilver Scholar Money Rewards Credit score Card?

Whether or not or not you need to get the Capital One Quicksilver Scholar Money Rewards Credit score Card completely is determined by your spending habits at school — as a result of it’s all the time higher to let your spending habits decide your card, and never the opposite means round!

This card may be a match if:

The Capital One Quicksilver Scholar Money Rewards Credit score Card may be a match for those who don’t plan on producing debt of any form at school and also you worth easy, easy money rewards.

The cardboard’s potential for sky-high rates of interest and lack of debt-forgiveness are extraordinarily dangerous — however for those who’re assured you’ll all the time have the ability to repay your steadiness, it’s rewards might make up for the chance.

This card may not be a match if:

Conversely, for those who doubt your skill to repay your bank card every month when you’re at school, you need to most likely keep away from utilizing the Capital One Quicksilver Scholar Money Rewards Credit score Card.

In case you’re a scholar, you most likely have sufficient to fret about earlier than including snowballing bank card debt to the plate.

It’s additionally not an ideal match for those who’re the type of one that likes maximizing coupons and rewards — you could be happier with a card providing 3% money again in sure classes.

Lastly, for those who’re searching for a scholar bank card just for use in case of emergency, it will make extra sense to get a card with a signup and/or anniversary bonus, because you’ll make more money rewards for making only a handful of purchases every semester.

The right way to apply for the Capital One Quicksilver Scholar Money Rewards Credit score Card

In case you determine the Capital One Quicksilver Scholar Money Rewards Credit score Card is an efficient match, head to the cardboard’s utility web page, the place you’ll be able to re-familiarize your self with the cardboard’s advantages.

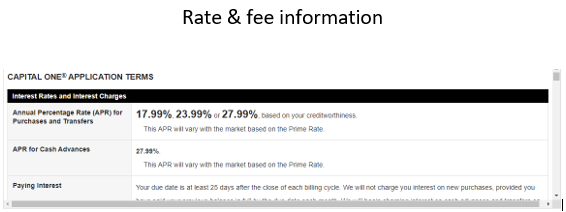

Be sure you additionally fastidiously comb via the cardboard’s Price and Payment Data, situated in a scrolling window on the backside of the web page:

Observe that once you apply, you’ll should share your diploma sort and anticipated commencement date, in addition to estimated annual revenue. Don’t fear in case your revenue is low — you gained’t be disqualified, you’ll simply begin out with a barely decrease line of credit score (e.g., $3,000 as an alternative of $5,000).

When you’ve accomplished and submitted your utility, you’ll obtain your card within the mail inside 7-10 enterprise days. And since there’s no ticking clock on a signup bonus, there’s no rush to make use of the cardboard when you activate it!

Abstract

The Capital One Quicksilver Scholar Money Rewards Credit score Card is a superb match for the scholar who can all the time pay it off and appreciates easy, easy rewards. Its doubtlessly excessive APR and lack of debt-avoiding security nets are vexing, even threatening, however so long as you may make your funds, you’ll get pleasure from a card with strong money again and much more beneficiant perks.

For Capital One merchandise listed on this web page, a number of the above advantages are offered by Visa® or Mastercard® and will differ by product. See the respective Information to Advantages for particulars, as phrases and exclusions apply.