Table of Contents

I usually wouldn’t suggest paying for a third-party prolonged guarantee. They’re overpriced and usually price much more than the repairs they’re alleged to cowl, rendering them kinda pointless.

But when your bank card firm is providing to increase the producer’s guarantee without cost, properly that’s one other story.

And consider it or not, that’s what many bank card corporations are doing nowadays. In case your fancy Samsung TV doesn’t activate six months after the Samsung guarantee runs out, there’s a darn good likelihood that Chase will really purchase you a brand new one.

So let’s examine bank card prolonged guarantee safety. What’s it? How does it work? What does it cowl? And the way are you aware if you have already got it?

What’s Forward:

What’s bank card prolonged guarantee safety?

Whenever you purchase a product along with your bank card that has a producer guarantee connected, your bank card’s prolonged guarantee safety will routinely lengthen that guarantee by one yr (in uncommon circumstances, two years).

So in case you purchase a Dyson vacuum cleaner with a two-year producer guarantee, your bank card provides one other yr for a complete of three.

If it’s one thing like a refurbished Amazon Fireplace Pill with a brief 90-day guarantee, your bank card will nonetheless lengthen it by a yr for a complete of 15 months.

It’s value noting that the majority bank card prolonged guarantee safety solely applies to warranties beneath three years. So your IKEA “UTESPELARE” desk that got here with a 10-year guarantee doesn’t get the bonus yr. (However have been you actually gonna preserve it for 11 years?)

Anyhow, if the product then fails through the prolonged guarantee safety interval — not the producer’s authentic guarantee interval — you’ll file a declare along with your bank card firm. They’re those who will reimburse you for the restore/substitute.

How does prolonged guarantee safety work?

Let’s say you purchase a PlayStation 5 along with your Chase Freedom Flex℠ card. Sony’s producer guarantee ensures your PS5 to be free from defects for one yr. Nice.

Then, on month 15, your PS5 fails besides up. You name Sony buyer assist they usually say that since your PS5 is now out of guarantee, you’ll must pay $300 for repairs.

Ugh.

Then you definitely keep in mind that your Chase Freedom FlexSM card contains prolonged guarantee safety. So that you collect the required paperwork (the unique retailer receipt, a duplicate of Sony’s guarantee, and the restore quote from Sony) and file a declare with Chase.

Then Chase’s third-party insurance coverage firm, Indemnity Insurance coverage of North America, approves the declare and Chase offers you a press release credit score for $300 to cowl the restore.

Case closed!

How do I file a declare?

Your card’s information to advantages could have directions for the way and the place to file a declare.

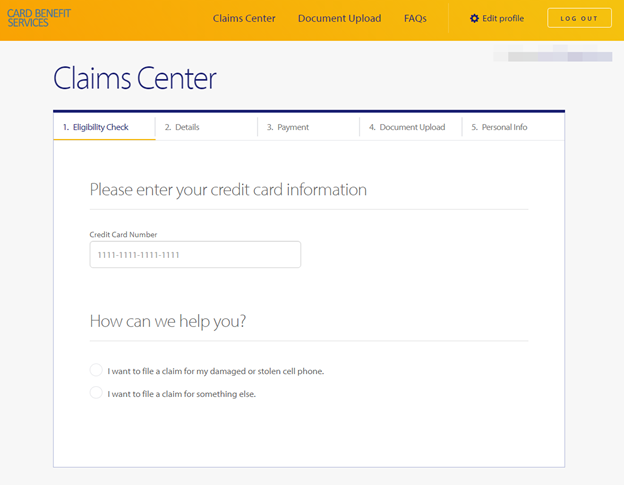

To proceed utilizing Chase for instance, you’ll create an account with Card Profit Providers and might want to present the next inside 90 days of the break:

- A scan of the unique retailer receipt.

- A replica/PDF of the producer’s native guarantee.

- The damaged merchandise’s serial quantity.

- A screenshot of your account assertion exhibiting the unique buy.

- In some circumstances, you may additionally want to supply a duplicate of a diagnostic/restore quote from a service heart so your bank card firm can reimburse you for the right quantity.

- Lastly, if you have already got a third-party guarantee, you’ll want to incorporate that additionally, for the reason that prolonged guarantee safety kicks in secondary to any additional guarantee safety you got (additional highlighting why you shouldn’t purchase it).

Supply: Chase Card Profit Providers, screengrab by Chris Butsch

Then, you’ll hear again from a advantages administrator inside every week or two whether or not your declare was accepted or denied.

Within the former case, you’ll get a press release credit score to cowl the restore or substitute.

If denied, they might simply ask for extra paperwork. Or, it’s possible you’ll simply be out of luck as a result of your buy wasn’t eligible within the first place.

So, to save lots of you a while, what sort of stuff is and isn’t eligible for bank card prolonged guarantee safety?

What’s lined by prolonged guarantee safety (and what isn’t)?

What it covers

Bank card prolonged guarantee safety usually covers any equipment, digital, console, piece of furnishings, instrument, or different product that features a producer guarantee. Surprisingly, it even applies to purchases made internationally.

The listing of lined classes and merchandise is broad, so it really makes extra sense to slim it down primarily based on what’s not lined.

What it doesn’t cowl

Bank card prolonged guarantee safety usually doesn’t cowl:

- Objects with a producer guarantee of three or extra years.

- Vehicles, boats, plane, and different types of private transport.

- Objects bought for resale, skilled, or industrial use (i.e., video gear on your small enterprise).

- Software program.

- Used or pre-owned objects (licensed/refurbished objects are literally lined, so long as they got here with a guaranty of beneath three years).

- Rented or leased objects.

- Medical gear.

- Injury brought on by modification.

- One-of-a-kind objects.

- Something residing (vegetation, seeds, and so on.).

- Prices that aren’t lined beneath the unique producer guarantee (transport each methods, deductibles, and so on.).

- Everlasting fixtures (i.e., ceiling followers).

Now, prolonged guarantee safety does cowl your smartphone, but it surely’s necessary to remember that it’s solely ever an extension of the unique producer’s guarantee. It gained’t cowl cracks, breaks, or theft — solely producer defects.

That being mentioned, your bank card might embrace Cell Cellphone Safety as a perk, which does cowl theft and breaks, so test your information to advantages.

Greatest bank cards for prolonged guarantee safety

Total: Chase Freedom FlexSM

The Chase Freedom FlexSM is my high decide for a bank card to get for prolonged guarantee safety for a few causes:

- Its $200 welcome bonus may help to offset no matter massive buy you’re seeking to get prolonged guarantee safety for.

- 15 months of 0% APR may help you fiscal that massive buy.

For a giant buy: Chase Sapphire Most popular®

The Chase Sapphire Most popular® Card is an excellent card for prolonged guarantee safety as a result of though it doesn’t provide 0% APR, it comes with a monster of a sign-up bonus: 60,000 bonus factors after you spend $4,000 on purchases within the first 3 months from account opening. That is $750 towards journey when redeemed by Chase Final Rewards®.

That’s why the favored “CSP” is ideal for making a giant money buy like a TV or an equipment — you’ll get $600 off and beneficiant prolonged guarantee safety to cowl it.

Apply for the Chase Sapphire Most popular® or learn our full evaluation.

For journey: Capital One Enterprise X Rewards Credit score Card

In the event you’re a frequent traveler seeking to lengthen the producer guarantee of your baggage, cameras, and so on., you may just like the Capital One Enterprise X.

Along with one yr of prolonged guarantee safety, you possibly can preserve your choices open with 90-day Return Safety, which helps you for returns on qualifying purchases that the shop gained’t take again. Prolonged guarantee safety additionally covers injury or theft inside 90 days of buy. This card does include a $395 annual price.

Apply for the CapitalOne Enterprise X or learn our full evaluation.

For saving on necessities: American Categorical Blue Money Most popular

In the event you’re not seeking to make a giant Amazon buy and simply desire a card with prolonged guarantee safety that may show you how to save on necessities, look no additional than the Amex Blue Money Most popular.

Proper now the cardboard gives 6% money again on groceries and streaming, 3% again on transit and gasoline, 0% APR for 12 months, and a $300 sign-up bonus.

To be taught extra concerning the quirks of American Categorical playing cards, be sure you learn “Are Amex playing cards value it?”

What to search for in an prolonged guarantee safety

Most prolonged guarantee safety advantages look and act the identical, but it surely pays to control sure key phrases like:

Size

Does the prolonged guarantee safety add a yr? Two years? One thing else?

Additionally, how lengthy can the OEM guarantee be for the prolonged safety to use? Some playing cards cease at three years, some at 5.

Protection limits

A typical restrict is $10,000 per declare, $50,000 per cardholder — however protection can fluctuate.

Product eligibility

Is your massive upcoming buy lined beneath this particular card’s plan? Strive calling them as much as make 100% certain earlier than you apply for a card beneath the fallacious pretenses.

Declare necessities

Lastly, how a lot paperwork will you must appease the insurance coverage adjuster? Most of it you possibly can in all probability discover on-line (statements, guarantee data, and so on.) however you’ll need to save and scan that in-store receipt!

The underside line

Prolonged guarantee safety is likely one of the greatest hidden perks of recent rewards playing cards. Certain, there’s some endurance and paperwork concerned, but when you will get Chase to comp you for a brand new dishwasher, that’s a helluva lot higher than a $200 sign-up bonus!

For extra on our high rewards playing cards, try our picks for the most effective bank cards of the yr.

Featured picture: Toey Andante/Shutterstock.com

For Capital One merchandise listed on this web page, a few of the above advantages are supplied by Visa® or Mastercard® and will fluctuate by product. See the respective Information to Advantages for particulars, as phrases and exclusions apply.