Table of Contents

The Indigo® Mastercard® Credit score Card gives customers with poor credit score the chance to make use of a bank card for on a regular basis spending. Pre-qualification is fast and simple and you probably have the credit score profile wanted, you may have the ability to safe a bank card with no annual payment. ($0 – $99 annual payment).

What We Like:

-

$0 – $99 annual payment

-

Simple pre-qualification course of

-

Earlier chapter is OK

Intro APR Purchases

N/A

Intro Time period Purchases

N/A

Intro APR Steadiness Transfers

N/A

Intro Time period Steadiness Transfers

N/A

Common APR

24.9%

Annual Charge

$0 – $99

- Simple pre-qualification course of with quick response

- Lower than good credit score is okay

- On-line servicing obtainable 24/7 at no extra price

- Unsecured bank card, no safety deposit required

- Account historical past is reported to the three main credit score bureaus within the U.S.

Editor’s Notice – You may belief the integrity of our balanced, unbiased monetary recommendation. We might, nevertheless, obtain compensation from the issuers of some merchandise talked about on this article. Opinions are the creator’s alone. This content material has not been offered by, reviewed, authorised or endorsed by any advertiser, until in any other case famous under.

The Indigo Credit score Card is issued by Celtic Financial institution, a privately owned industrial financial institution based mostly in Salt Lake Metropolis, Utah.

Designed for individuals who have a poor credit score historical past — or haven’t any credit score historical past in any respect — the Indigo® Mastercard® doesn’t require a safety deposit. That is an intriguing attribute for folks simply starting their credit score journey or with no further money to place towards opening an account.

Nevertheless, as a result of the Indigo Card carries a minimal APR of 24.9% (5 foundation factors above the U.S. common of 19.07%) and begins at a credit score restrict of solely $300, it will not be an ideal match for everybody.

Able to study extra? Let’s check out the main points.

Is the Indigo Card for me?

The Indigo Card is an efficient match for just a few various kinds of folks.

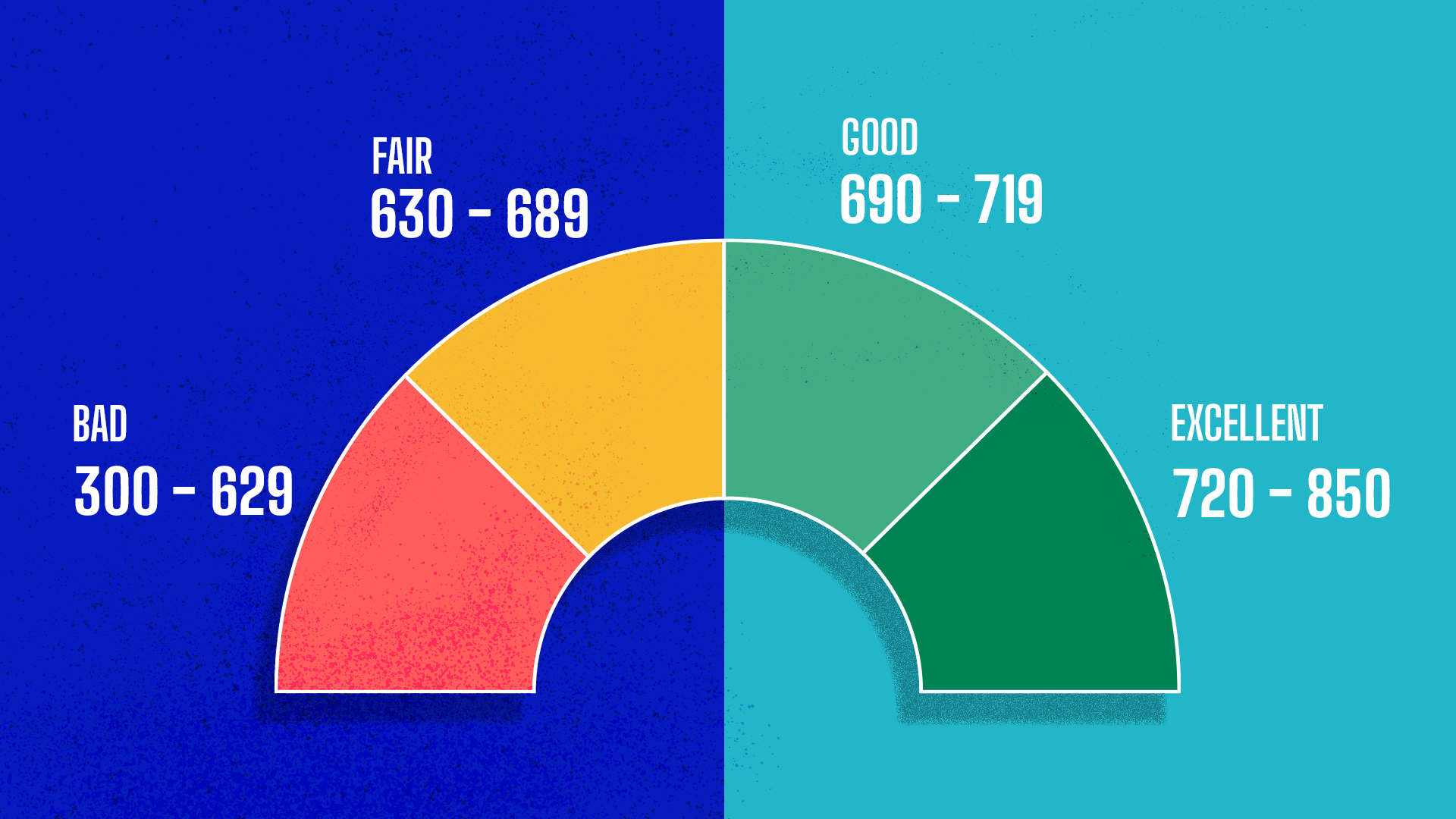

Provided that this card is designed that can assist you construct or rebuild your credit score, it really works finest for these with a poor credit score rating (sometimes between 300 and 579) or no credit score.

This card doesn’t require a safety deposit, which means it really works nice for people who find themselves brief on money or unwilling to supply a deposit. Its low restrict additionally makes it an excellent match for individuals who need to scale back the temptation to overspend.

Briefly, this card is likely to be an excellent possibility you probably have poor or no credit score and restricted funds.

What makes this bank card totally different?

There isn’t a lot concerning the Indigo Card to distinguish it from the competitors. There are a lot of bank card corporations that provide unsecured playing cards designed for folks with poor or restricted credit score. Just like the Indigo Card, these playing cards are inclined to have high-interest charges and costs to compensate for the truth that no safety deposit is required.

Nevertheless, one distinction is how the Indigo Card handles rates of interest and costs for folks with totally different credit score profiles.

Most playing cards have comparatively set charges and may additionally have a small vary of rates of interest that they’ll cost based mostly on every applicant’s credit score historical past.

In distinction, the Indigo Card has 20 totally different card agreements listed on its web site, every with totally different rates of interest and costs. Some agreements embody annual charges, whereas others use a month-to-month payment construction. Some have a waived or lowered payment within the first yr, whereas others cost the total payment instantly.

This offers the cardboard issuer flexibility, tailoring the cardboard supplied to the borrower’s credit score historical past and approving extra folks.

What are my probabilities of getting authorised?

Nothing is assured, however the Indigo Card is explicitly designed for folks with poor or no credit score. So until you’ve had main monetary emergencies lately, like declaring chapter, you have got an excellent likelihood of qualifying.

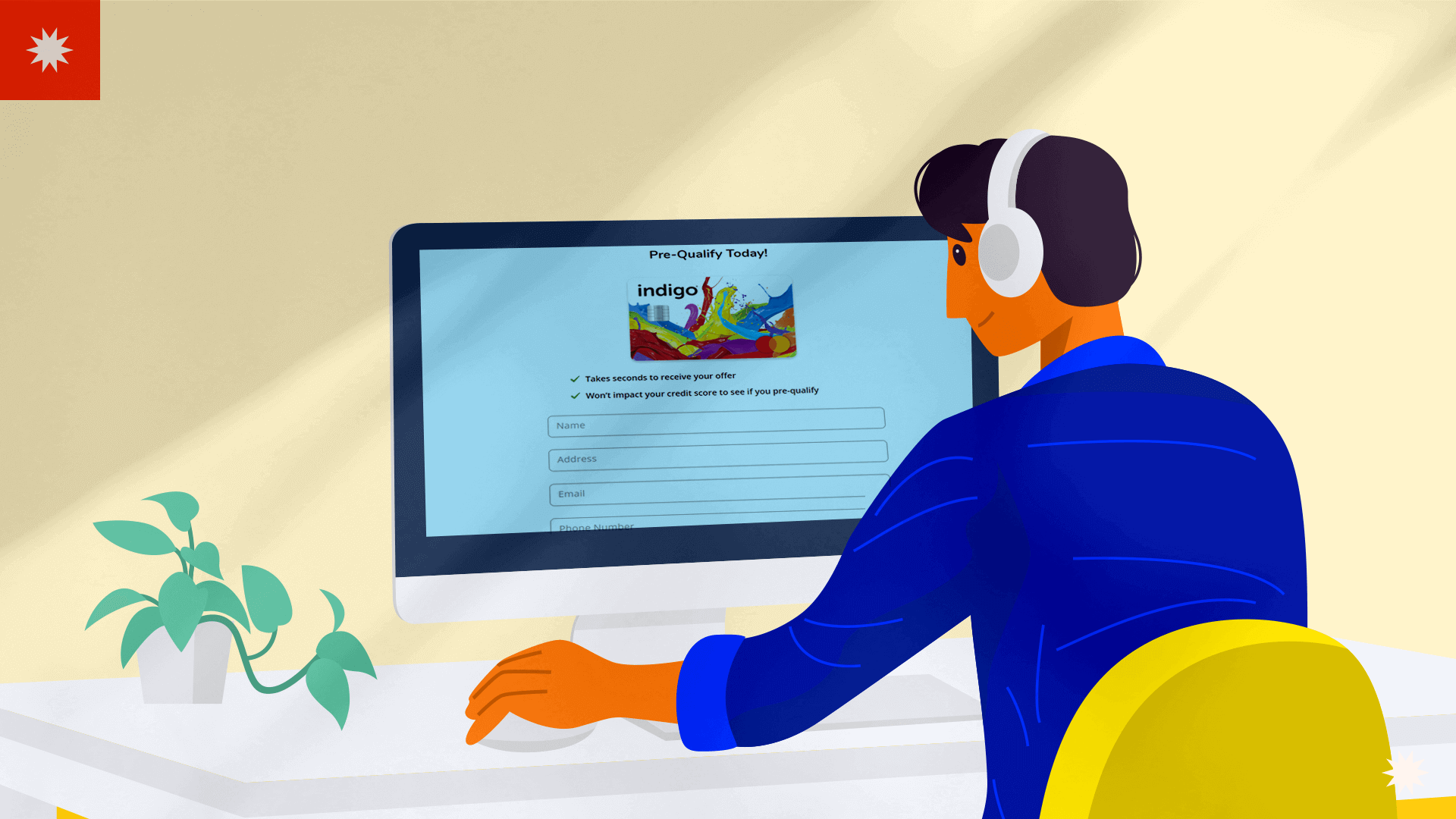

You may even pre-qualify for the Indigo Card to see in case you’re eligible. This doesn’t affect your credit score and can provide you a good suggestion of whether or not you’ll get authorised in case you submit a whole utility.

Take into account that you do have to fulfill some primary eligibility necessities. For instance, you have to be at the very least 18 years outdated (19 in Alabama) and haven’t beforehand had an Indigo Card that was cancelled because of delinquency.

All the main points of the Indigo Card

To essentially perceive whether or not the Indigo Card is an efficient match, it’s worthwhile to know all the card’s particulars, together with its charges and perks.

Charges and costs

As we’ve talked about, the Indigo Card has many alternative card agreements it will probably provide candidates, every with totally different payment buildings and rates of interest. Typically, you’ll be able to count on to cope with high-interest charges and an annual payment.

The more serious your credit score historical past is, the upper these charges will are usually.

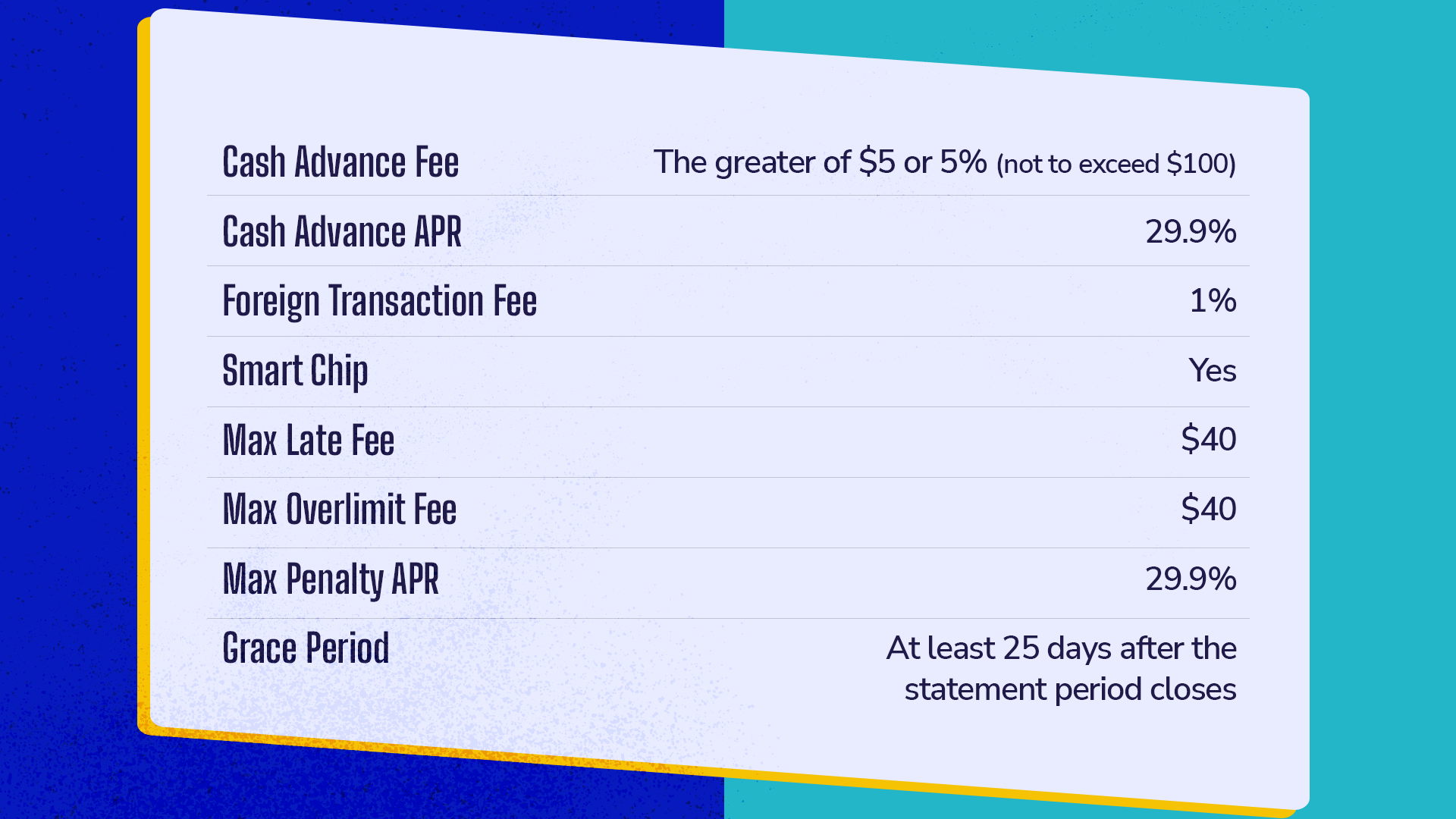

These different charges are commonplace throughout the cardboard agreements.

Perks and rewards

As a card designed to assist construct credit score, the Indigo Card experiences your account particulars to all three bureaus. Meaning you’ll be able to enhance your credit score scores at every bureau with only one card.

One other priceless perk is the cardboard’s overseas transaction payment. You should use the Indigo Card whereas touring exterior the U.S. and pay a overseas transaction payment of simply 1%. That is decrease than most playing cards.

Past these advantages, and like many Credit cards, you’ll get Mastercard ID Theft Safety™, which incorporates monitoring your Social Safety quantity, on-line accounts, debit and bank cards, and different particulars that can assist you keep away from id theft.

The Indigo Card additionally has Zero Legal responsibility safety for fraudulent use and the choice to get a substitute card freed from cost.

The best way to apply

To use for the Indigo Card, you could go to the Indigo Card web site. There isn’t any paper utility or possibility to use by telephone.

To start out the method, you’ll fill out the pre-qualification kind. This kind asks for primary particulars, like your contact data, debt, and revenue. Primarily based in your credit score profile and the data you present, Indigo Card will let you understand whether or not you qualify and your predicted credit score restrict and costs.

If the pre-qualification comes again with a tentative approval, you’ll be able to proceed to the total utility. If authorised, you’ll obtain your card within the mail inside two weeks.

Contact information

In the event you run into issues along with your Indigo Card or have questions concerning the account, you’ll be able to attain out to the Indigo Card’s customer support group utilizing the next contact data:

- Buyer Service: 1-800-353-5920.

- Misplaced/Stolen Division: 1-800-314-6340.

- Mailing handle: Genesis FS Card Companies | PO Field 4477 Beaverton, OR | 97076-4477.

Different stuff it’s best to know

Earlier than you apply for the Indigo Card, there are another issues try to be conscious of.

One of the vital issues to notice is that the cardboard prices its annual payment instantly, which can scale back your obtainable credit score till you pay it. For instance, in case you get a card with a $75 annual payment and a $300 credit score restrict, your card will include a $75 stability and $225 in obtainable credit score.

When you pay the payment, you’ll have the ability to use the total $300 credit score restrict.

The Indigo Card additionally gives a money advance operate that you should use to withdraw cash at ATMs and most monetary establishments. Nevertheless, money advances contain a payment and begin accruing curiosity instantly, so it’s best to keep away from utilizing the service until vital.

Lastly, the cardboard doesn’t provide rewards, money again, or sign-up bonuses.

Different bank cards to the Indigo Card

The Indigo Card is only one of many playing cards focused at individuals who need to construct their credit score. In the event you’re not sure that the Indigo Card is best for you, think about the next options:

- Milestone Mastercard®. One other unsecured card designed to assist construct credit score. Pre-qualify with out impacting your credit score.

- Petal® 2 “Money Again, No Charges” Visa® Credit score Card. No annual payment and 1%–1.5% money again. Designed to assist folks construct credit score.

- Capital One Platinum Secured Credit score Card. No annual payment and a deposit as little as $49. Computerized credit score restrict will increase.

- U.S. Financial institution Money+ Secured. $300 deposit and no annual payment. Earn as much as 5% money again.

- Capital One Quicksilver Secured Money Rewards Credit score Card. $200 deposit and no annual payment or overseas transaction charges. Earn 1.5% money again on all purchases.

How do you establish which bank card is best for you?

When evaluating bank cards and deciding on the suitable one to your wants, think about the next elements:

- Means to qualify. Completely different playing cards are focused at totally different credit score profiles. There’s no level in making use of for playing cards you can’t qualify for.

- Charges. Some playing cards, significantly playing cards for folks with poor credit score and premium journey playing cards, cost annual charges. Be certain that the advantages are value the fee. Many individuals can do effectively with playing cards that haven’t any annual payment.

- Perks. Completely different playing cards include totally different perks. Journey playing cards, for instance, may get you premium airline standing. Search for a card that provides perks that you simply’ll use recurrently.

- Rewards. You may earn money again, factors, or miles with many bank cards. Search for a card that provides rewards you should use simply, and that has excessive incomes potential based mostly on its reward classes and your spending habits.

- Charges. When you ought to keep away from carrying a stability each time attainable, generally you’ll want extra time to pay your card off. Search for a card with a low-interest price in case you count on to hold a stability recurrently.

Indigo Card FAQ

Does the Indigo Card require a safety deposit?

No. The Indigo Card is an unsecured bank card, which suggests you don’t have to offer a safety deposit.

Can I qualify with poor or no credit score?

Sure. The Indigo Card is designed to assist folks construct their credit score scores. It has a number of card agreements tailor-made to totally different credit score profiles and infrequently approves folks with poor or no credit score historical past.

Does the Indigo Card have an annual payment?

Sure, the Indigo Card prices an annual payment as excessive as $99 based mostly in your creditworthiness.

What’s the Indigo Card’s credit score restrict?

The Indigo Card’s typical credit score restrict is $300.

Does the Indigo Card provide rewards?

No, the Indigo Card doesn’t provide rewards.

What’s the Indigo Card’s rate of interest?

The Indigo Card rate of interest can vary from 24.9% to 29.99% based mostly in your creditworthiness and whether or not you’re paying curiosity on a purchase order or money advance.

Execs & Cons

Execs

-

You Do not Want Good Credit score — You could be authorised with poor credit score.

-

Get Authorized Shortly — Fast prequalification course of.

Cons

-

Pricey Curiosity Costs — This card has a excessive commonplace rate of interest.

-

Excessive Annual Charges — This card has an annual payment of as much as $99.

Why select the Indigo Card?

The Indigo Card has a reasonably particular area of interest — folks with poor credit score scores who don’t need or can’t afford a secured card.

The cardboard carries charges as excessive as $99 per yr, relying in your creditworthiness, and a minimal APR of 24.9% — increased than the nationwide common. Nevertheless, until you have got a low credit score rating, chances are you’ll get authorised for a proposal with barely decrease charges, making this card a extra aggressive possibility.

And with correct use — maybe a yr or two of creating on-time funds — you might be able to construct enough credit score to maneuver on to a fee-free card with a better restrict.

If this appears like an excellent match, you’ll be able to apply now.