Table of Contents

“What are the most effective bank cards for younger adults?” is among the most often-asked questions I get. That, or:

- I’m a current school graduate. What’s the most effective starter bank card for me?

- What’s the most effective first bank card to get?

- I’m a younger skilled with some credit score historical past. I want a bank card for enterprise journey—what ought to I get?

I’m comfortable to dive into these questions, however I additionally wish to clarify why I like to recommend the playing cards I do.

What’s Forward:

How I got here up with the checklist of the highest 10 bank cards for younger adults

I’ve been masking credit score and bank cards for over 10 years. When selecting the most effective bank cards for younger adults, I search for playing cards that:

- Supply better-than-average approval odds for shoppers with shorter credit score histories. (That is based mostly upon issuer-provided pointers and Cash Beneath 30 information from readers who click on from our Web site to use for a bank card.)

- Reward spending in classes hottest with our readers resembling eating, journey or Amazon purchases

- Don’t cost extreme charges

The place applicable, I chosen rewards playing cards with packages that reward any spending degree—not simply somebody who can cost hundreds a month to their card. I additionally tried to stay to playing cards with no annual charges, though there are two exceptions.

Overview: Finest bank cards for younger adults

Within the occasion you don’t have a lot of a credit score historical past but, purchasing for playing cards could be irritating. You discover an incredible bank card, solely to be declined. If essentially the most rewarding bank cards are nonetheless out of attain, there are nonetheless excellent bank cards designed for shoppers with common or restricted credit score.

| Card | Finest for: | Credit score Rating Required |

|---|---|---|

| Chase Sapphire Most well-liked® Card | Premium Journey Rewards | Glorious |

| Ink Enterprise Money® Credit score Card | Entrepreneurs | |

| Chase Freedom Limitless® | On a regular basis purchases rewards | |

| Citi® Double Money Card – 18 month BT provide | Steadiness transfers + money again | Good/Glorious |

| Capital One Platinum Credit score Card | No annual payment | |

| Chase Freedom® Pupil Credit score Card | College students | |

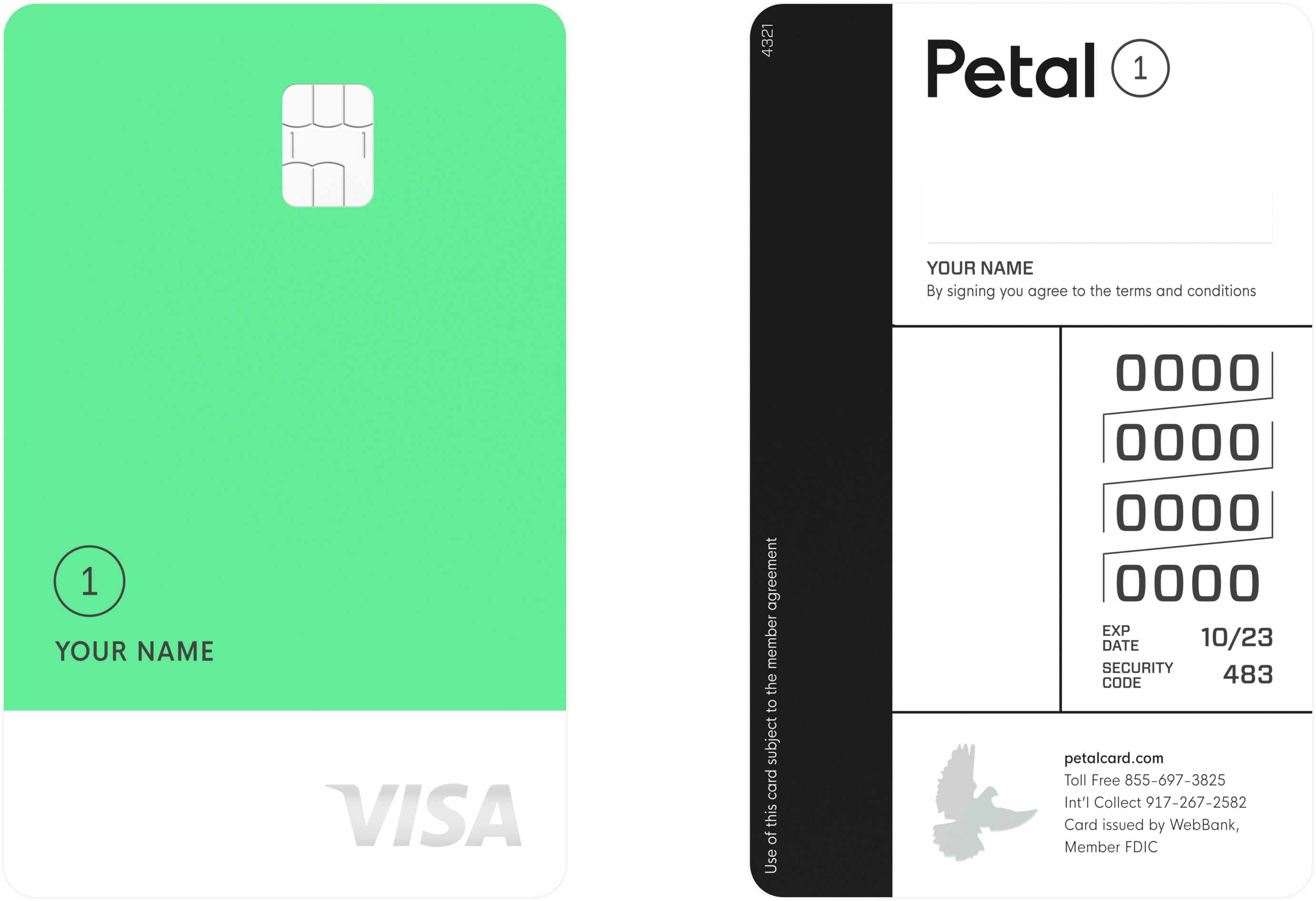

| Petal® 1 “No Annual Price” Visa® Credit score Card | Constructing credit score whereas incomes rewards | Poor (300 – 599) |

| Capital One Platinum Secured Credit score Card | First bank card—credit score builder |

Particulars: Finest bank cards for younger adults—good-excellent credit score

The easiest bank card presents look to draw new creditworthy clients with promotions like money sign-up bonuses, 0% intro APRs and beneficiant rewards packages.

These playing cards require good or glorious credit score, which implies you will want to:

- Have had open mortgage and bank card accounts for 5 years or extra

- Have had no late funds within the final two years

- Haven’t utilized for credit score greater than twice within the final 12 months

When you’re a younger skilled with established credit score, listed below are a few of our really helpful bank cards:

The Chase Sapphire Most well-liked® Card is unquestionably one in every of our favourite journey rewards playing cards, however don’t apply except you’re a giant spender (and a giant traveler).

First the great. The Chase Sapphire Most well-liked® Card earns 5X factors on journey bought by way of Chase Final Rewards®, 3X factors on eating, 2X factors on all different journey purchases, and 1 level per $1 spent on all the pieces else.

On prime of that, you may get a whopping 60,000 bonus factors after you spend $4,000 on purchases within the first 3 months from account opening. That is $750 towards journey when redeemed by way of Chase Final Rewards®.

Right here’s the kicker. There’s a $95 annual payment. You actually must be a giant spender to make this card price your whereas. When you wish to keep away from the annual payment, we suggest trying on the various playing cards right here. However if you happen to’re dwelling massive, that is the right card for you.

Be taught extra: See card particulars/apply or learn our Chase Sapphire Most well-liked® Card evaluation.

In case you are simply beginning to construct credit score with accountable use, the Capital One Quicksilver Pupil Money Rewards bank card supplies a superb likelihood of approval, with no annual payment and a beneficiant 1.5% money again.

With the Capital One QuickSilver Pupil Money Rewards Credit score Card, you’ll earn 1.5% money again on each buy with no rotating classes or hoops to leap by way of.

Plus, it comes with a restricted time sign-up bonus: earn $50 if you spend $100 on purchases inside 3 months from account opening.

Be taught extra: See card particulars/the place to use or learn our full evaluation.

Providing enhanced money again in sure classes, the Capital One SavorOne Pupil Money Rewards bank card will enchantment to those that wish to profit from their spending.

With the Capital One SavorOne Pupil Money Rewards Credit score Card, you’ll earn a fundamental 1% money again on all purchases, except just a few spending classes that enhance your earn potential considerably. The cardboard presents:

- 3% money again on eating, leisure, and at grocery shops.

- 3% money again on common streaming providers.

- 8% money again on all qualifying Capital One Leisure purchases.

Just like the Quicksilver Pupil Money Rewards card, it additionally comes with a restricted time sign-up bonus of $50 bonus if you spend $100 on purchases inside 3 months from account opening.

Be taught extra: See card particulars/the place to use or learn our full evaluation.

The Capital One Platinum Credit score Card is a superb fundamental bank card with no annual payment for candidates with common or restricted credit score.

In case you have a little bit little bit of credit score historical past (or a good one that you simply wish to enhance), the Capital One Platinum Credit score Card is a perfect starter bank card. You received’t earn rewards with this card, however there’s no annual payment to fret about, both.

One of many nice issues about Capital One is that they provide playing cards like this and nice prime rewards playing cards. So, if you happen to begin with a Platinum card and use it responsibly for some time, you might be able to improve your account.

Be taught extra: See card particulars/apply or learn our Capital One Platinum Credit score Card evaluation

When you’re nonetheless constructing your credit score historical past and wish to earn rewards to get the buying energy you want, the Petal® 1 “No Annual Price” Visa® Credit score Card is a superb money again card with no charges.

You received’t pay an annual payment, and even worldwide transactions are fee-free. For somebody simply beginning out, each greenback saved is a greenback earned.

And when you’re constructing your credit, why not additionally be capable to earn rewards! You possibly can earn money again between 2%-10% again on spending at particular retailers. All it’s important to do is verify the app to search out presents close to you and your money again will then be issued as a press release credit score or could be despatched to you through verify or ACH if over $20.

The Petal® 1 “No Annual Price” Visa® Credit score Card has an APR of 24.49% – 33.99% Variable, and also you’ll be issued a credit score restrict between $500 and $5,000. This isn’t negotiable, however when you’ve constructed your credit score rating, you’ll be able to parlay it into a better restrict with one other card.

Be taught extra: See card particulars/apply.

Considered one of my prime money again bank card picks for younger adults is the Chase Freedom® Pupil Credit score Card. It’s a nice card to spice up your credit score rating whereas having fun with some money again advantages on the identical time. You’ll get 1% money again on each greenback you spend, together with bonuses and occasional promotional presents that can earn you much more.

With the Chase Freedom® Pupil Credit score Card, you’ll take pleasure in an rate of interest of 19.49% Variable. This rate of interest doesn’t expire after an introductory interval, so that you’ll proceed to get the comparatively low APR for the lifetime of the cardboard.

To sweeten the deal, Chase is providing a $50 bonus after first buy made throughout the first 3 months from account opening. Which means you’ll get 5,000 factors you can redeem as money again, only for spending any quantity!

Though the APR is a little bit larger than some others, the rewards are nicely price it, particularly if you happen to make common purchases. Better of all, you’ll be constructing credit score when you earn money again.

Be taught extra: See card particulars/apply or learn our full evaluation of Chase Freedom® Pupil bank card.

Particulars: Finest first bank cards—no safety deposit

When you’ve by no means had a bank card or mortgage earlier than, a secured bank card presents your greatest likelihood of approval.

In case you have no credit score or very restricted credit score, you’ll must learn up on constructing credit score for the primary time. In some instances you’ll must get a particular sort of product referred to as a secured bank card that works like a debit card (with cash you deposit in a checking account) however helps you construct credit score.

The Capital One Platinum Secured Credit score Card has no annual payment and instantly permits you to start constructing credit score with accountable use.

A secured bank card works like a pay as you go debit card — it’s essential to first make a deposit. Not like a pay as you go card, nevertheless, a secured bank card might help construct credit score when used responsibly as a result of is will likely be reported to the three main credit score bureaus.

With the Capital One Platinum Secured Credit score Card, you’re going to get an preliminary $200 credit score line after making a safety deposit of $49, $99, or $200. Then get entry to a better credit score line in as little as six months after credit score line evaluation.

Be taught extra: See card particulars/apply or learn our Capital One Platinum Secured Credit score Card evaluation.

Abstract of the most effective bank cards for younger adults

| Bank card | Rewards | Distinctive options |

|---|---|---|

| Chase Sapphire Most well-liked® Card | 5X factors on journey bought by way of Chase Final Rewards®, 3X factors on eating, 2X factors on all different journey purchases. | Your factors are price 25% extra if you redeem journey by way of Chase Final Rewards® |

| Citi® Double Money Card – 18 month BT provide | 1% money again if you purchase plus 1% as you pay | You possibly can switch a stability with a 0% APR for 18 months. The continued APR is eighteen.49% – 28.49% (Variable). |

| Ink Enterprise Money® Credit score Card | 5% money again on the primary $25,000 spent in mixed purchases at workplace provide shops, and on web, cable, and telephone providers

2% again on the primary $25,000 spent in mixed purchases on fuel and eating Limitless 1% money again on all different purchases |

A welcome bonus of $750 bonus money again after you spend $6,000 on purchases within the first 3 months after account opening. |

| Chase Freedom Limitless® | 5% on journey booked by way of Chase Final Rewards®, 3% on eating and drugstores, and 1.5% on all different purchases | Intro Supply: Earn a further 1.5% on all purchases (as much as $20,000 spent within the first 12 months) – price as much as $300 money again! |

| Capital One Platinum Credit score Card | None | No annual payment or international transaction charges |

| Chase Freedom® Pupil Credit score Card | 1% money again on all purchases | $50 bonus after first buy made throughout the first 3 months from account opening |

| Petal® 1 “No Annual Price” Visa® Credit score Card | 2%-10% money again on choose retailers | No annual payment or international transaction charges; Free in-app monetary administration software |

| Capital One Platinum Secured Credit score Card | None | Entry to a better line of credit score if you happen to make your first six funds on-time |

Incessantly requested questions

Can I get a bank card if I’m beneath 21?

Good query. In 2009, the U.S. CARD Act created new legal guidelines designed to forestall some abusive practices within the bank card trade. Amongst these is a regulation that regulates corporations issuing bank cards to minors. As we speak, you have to be a minimum of 18 years outdated to get a bank card.

Candidates beneath 21 must show their monetary independence through both revenue or belongings—in different phrases, your skill to repay the debt. In lots of instances, even a small part-time job could also be sufficient to qualify you for a bank card with a modest credit score restrict.

When you’re beneath 21 and would not have sufficient unbiased revenue, you’ll want a cosigner to use for a bank card.

In both case, keep in mind that you’ll have the monetary duty to pay your bank card each month. When you can’t afford it, don’t apply!

How do I get a bank card if I’ve no credit score historical past?

No matter your age or scholar standing, if you happen to don’t have any credit score historical past but (for instance, you’ve by no means had a scholar mortgage, automotive mortgage, or bank card), you might have a tough time getting accepted for any conventional bank card.

Secured bank cards are an exception to this rule, and so they’re one of the best ways to construct credit score for the very first time.

At first, a secured card works extra like a debit card; you deposit cash right into a checking account earlier than you should use the cardboard.

The distinction, nevertheless, is that the secured bank card will report your accountable use of the cardboard to credit score bureaus and aid you construct credit score in a approach that debit and pay as you go playing cards don’t.

Be taught extra about methods to construct credit score for the primary time or verify your credit score report to see if you happen to’ve begun constructing credit score but.

Do you will have any suggestions for utilizing a bank card for the primary time?

Bank cards can provide a ton of distinctive advantages, together with fancy rewards, journey advantages, money again, and extra. However don’t neglect, the principle cause to begin utilizing bank cards is to construct your credit score rating.

Making use of for a bank card (and being accepted for it) is simply the beginning of the method. Now it’s important to use that bank card responsibly, which implies:

- Use the cardboard – Your credit score rating will tick up as you borrow cash from the issuer (utilizing your bank card) after which pay them again. When you don’t use the cardboard, that may’t occur.

- Repay your stability in full – Most of the bank cards on this checklist have a excessive APR, particularly out there for individuals with poor credit score. That implies that if you happen to don’t repay your stability in full, you’ll be caught with high-interest funds on the rest of your stability. Don’t get sucked in with the attract of minimal funds. Pay in full every month.

- Repay your stability on time – You would possibly assume it’s not a giant deal to be late with a cost by a day or two. However it’s a massive deal. When you use this bank card and don’t pay your stability on time, your credit score rating will fall.

Bear in mind, bank cards generally is a supply of super worth – if you happen to use them accurately.

Abstract

When you’re beneath 35, the most effective bank card for you is the cardboard you may get accepted for that gives advantages that can prevent—not price you—cash.

When you don’t really feel like enjoying with spreadsheets for hours to find out the most effective private rewards charge you’ll find, simply choose a rewards bank card that sounds good to you and be accomplished with it. Don’t, nevertheless, blindly select a rewards card solely to hold a stability from time to time! In order for you a bank card with which to repay purchases over time, deal with the cardboard’s APR, not the rewards.

Discovering a bank card for which you can be accepted will likely be harder when you’ve got restricted or broken credit score, however there are alternatives. When you don’t get accepted the primary time, wait six months, focus on paying all your payments on time, and take a look at once more.

Need to enhance your probabilities of getting accepted for a bank card? Discovering the best bank card for you is way easier if you realize your credit score rating, and might slender your search to solely the playing cards you realize you’ll get accepted for. We’ve made it simple for you. When you don’t already know your rating, use our fast and free Credit score Rating Estimator software – then discover the right card for you!

For Capital One merchandise listed on this web page, a few of the above advantages are offered by Visa® or Mastercard® and will differ by product. See the respective Information to Advantages for particulars, as phrases and exclusions apply.

- Finest bank cards for a credit score rating over 750

- Finest bank cards for a credit score rating between 700 – 749

- Finest bank cards for a credit score rating between 650 – 699

- Finest bank cards for a credit score rating between 600 – 649

- Finest bank cards for a credit score rating beneath 599